4 things you should know about Mogo

Have bad credit? This lender will still give you a loan—but be wary

Have bad credit? This lender will still give you a loan—but be wary

—This story was updated on May 12, 2016 after comments from a Mogo spokesperson clarified that their initial free credit check does not impact credit score. Mogo has since revised the section of their website that was unclear on the matter—

You may already be acquainted with some of the financial tech startups that are challenging the world of Canadian personal finance, like Wealthsimple or Mint. Now there’s a new kid on the block named Mogo that has opened up its first brick-and-mortar store in Toronto. But don’t be fooled by this new storefront: It’s not a real bank, but rather a loan lender marketed towards millennials, offering fast and easy loans on its website. So should you trust this well-dressed outsider? “It’s a cool concept and in line with the robo-advisors that have started to disrupt traditional money managers,” says MoneySense Approved Financial Advisor Jason Health. Here’s four things you should know before using their services.

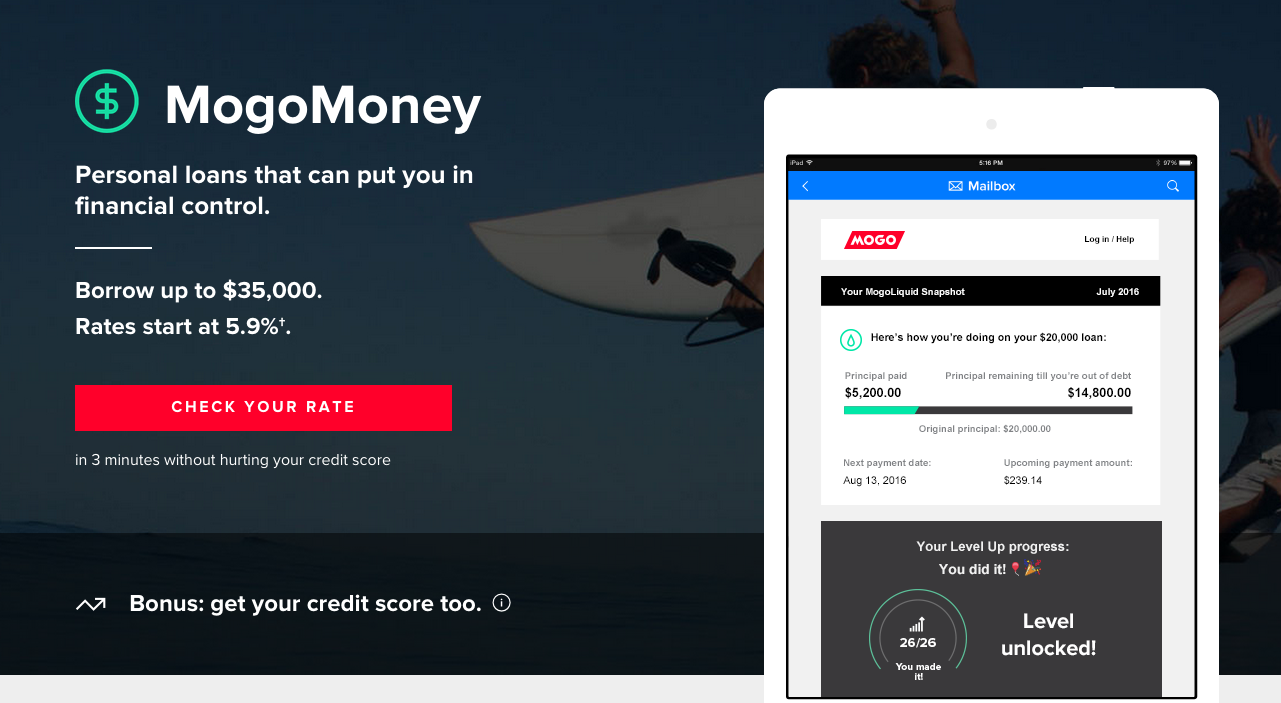

A credit score by a credit rating agency would usually cost you around $24, but comes free with Mogo when you sign up for an account. And you’re under no obligation to take out a loan; rather, that credit score will largely determine what amount you can qualify for and what type of interest rate you will be charged. For instance, a poor credit score rating of 500 would qualify you for a sky-high interest rate of 39.99% while a very good credit score rating of 800 would get you the considerably better interest rate of 5.9%.

As for whether that credit check will affect your credit score, Mogo claims that checking your rate won’t affect it. However, at the time of publication, Mogo’s FAQ section stated that it “really depends on your credit history.” Mogo has since revised this section to clarify that they do what is called a “soft check,” which has no effect on a credit score. Once you agree to the loan, Mogo then does a full bureau report—known as a hard check—which does impact your credit score.

Soft checks are often used by individuals to check their own credit score, or businesses in order to offer you goods and services. This contrasts a hard check, which does affect your credit score. A hard check will have a greater impact on those with short credit histories or few accounts.

What sets Mogo apart from more traditional lenders is that they won’t flat-out deny you a loan based on your credit score. So even those with poor credit scores may still qualify for one of three different types of loans Mogo offers. MogoLiquid is the largest type of loan offered, with amounts up to $35,000 available. MogoMini will grant you up to $2,500, while MogoZip offers an emergency advance loan of up to $1,500.

Debt repayment mistakes you’re probably making »

As a word of caution, those with bad credit need to be particularly careful when taking out a payday loan with MogoMini or MogoZip. Short-term, high-interest loans like MogoZip often cost a sizable chunk in interest charges on top of paying back the loan. Because of that, Heath doesn’t recommend these types of high-interest rate, short-term loans to anyone. But, he says, “at least if they can offer payday loans cheaper than the competitors by leveraging technology, they’re doing a service to Canadian consumers.”

If, for instance, you’ve got a bank loan with an interest rate of 9%, you may look to Mogo for a loan with an interest rate of 7%. That way you can pay off your higher-interest bank loan with the lower-interest Mogo loan and pay less interest in total, saving you a chunk of change. Heath points out that the “opportunity to pay off higher-rate debt with a lower interest rate option makes sense generally, as long as there are no strings attached.”

Mogo offers something called MogoCard, which is their fancy name for a reloadable prepaid Visa card. You load it with money in advance, and then use it like a credit card. There’s no interest to be paid on it, and since it’s not an actual credit card, there’s no need to get a credit check to get one.

Cards like these are often touted as a financially responsible way to keep a lid on spending by avoiding debt or overdraft charges—particularly for younger people. But as with most prepaid credit cards, there are still fees attached. For instance, Mogo earns money with their prepaid cards by deducting $1.50 from the prepaid funds for ATM cash withdrawal. While there are no monthly fees or loading fees, if you don’t use the card for 91 days, Mogo charges you an inactivity fee of two dollars per month until your balance is zero.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

MOGO is a predatory company scamming people least able to afford taking any sort of loan with them. All under the guise of a friendly app based business model. Stay away, just stay far away from this company.

hey Mogo,what exactly do you say about this….huys are giving negative comments about your company!!!

How do you use this card

Mogo is a complete money making scam. I applied for a $300 “loan” over a one year term and have been making $30 a month payment for one year now. Guess what my principal balance is after one year? That right, $300. All those payment have been going into their pockets as “interest”. Stay away from MogoScam!!

I dont think these comments are legit, of course Mogo is out to make money its a business give your head a shake. I’m usually good with money but hate to say it my uncle were right when I got married that all went to sh…t. Anyway I had to remortgage twice in two years then my bank hung me out on a limb. Sure they took almost all my debt but not all and was supposed to add extra for some necessities but that didn’t happen and not only that they closed my line of credit and also my credit card without mentioning it to me. I was worse off than before , still had a debt . I couldn’t believe I was doing it but.i was searching for payday advance sites. Tried a couple but found mogo and they have helped me significantly. After a few payday loans I applied for a mini line of credit and they approved. It was enough to help get through my hard time , and I borrowed $2500 my payments are about 83 biweekly and I’m down to $2000 in about 2 months, 300 would not take a year to pay. Mogo is what they are a money lender but they are fair and it does help with the app you can even purchase bit coin and they give you $10 just to activate that section so you can check it out. AnywY sorry for the novel rant but I had to comment. Mogo definately helped me , so thanks Mogo

Ok I’m out

Stay away. I got a loan with these guys and have been making payments of $140 a month for a year. My loan was for $1800. I still owe $1800. To top it off I lost my job as a result of COVID and have been communicating with them and told them my situation yet they still are debiting my account costing me countless nsf charges. When I ask them about it I get the “ I’m sorry and can’t imagine what you’re going through but there’s only so much I can do” they held 1 2 week payment and added that to my next payment and debited my account costing me nsf charges. After I told them I’m still waiting for ei and have no money. So stay clear. Use anyone else. Even cash money stopped all payments coming from my account and are giving me 2 months to get myself back on my feet. And that only took 1 5 minute phone call.

I’ve been a Mogo client for about 15 months. To clarify , when you take a mogomini loan , you only pay back the interest so your principle balance does not decrease. They are clear about that and they email you regularly to point this out .

My interest on a $300 loan was about $12 / paycheque . So about $25/month. It can be higher if you forget to remove the optional insurance – so don’t . I set up a regular debit to pay down the principle on top of the interest – don’t forget to do that , either.

My only issue is having received emails stating that my line of credit had been increased to x amount, then contacting them to be offered a lesser amount . Guys, sort that out prior to contacting your customers .

I’ve been using Mogo for about a year to track my credit rating, and to monitor when someone pulls my credit bureau. I was looking for a ‘safe’ site to purchase Bitcoin with a family member and Mogo were able to offer me the ability to purchase a large amount of it within their closed system. You cant access your wallet tp spend your BTC places, but neither can anyone else so its purely speculative. Its been pretty easy to use and their fee’s aren’t ridiculous compared to other sites.

I haven’t attempted to get a loan from them, but looking at their site their mortgage rates seem very competitive.

This company is just like all the others, promising people in a tight spot a chance but realistically they are greedy and only out to help themselves. They state when you apply with good payment history of your loan they will periodically assess and offer a better rate then initially given. Not only do they not do this, when you enquire about it they say you have to wait for the “offer” which never comes all well with the high interest you end paying for the total amount of the loan multiple times over. Not impressed. If you have any other options, run like hell away from this company. If you have no choice but to take their insanely high interest rate, do whatever is in your power to pay extra on it and pay it off as quick as possible. It’s legal robbery basically. I had higher hopes based on all their pitches claiming they aim to help people become smarter about money and borrow better when in reality they do not care to help you do any of that. I received a loan in July of 2019. It is now Aug of 2021. I’ve never missed a payment and have of a credit score of 670. My payments are $152 by weekly. So I have roughly paid $7,900 dollars of this loan which was originally $10,000. And yet I still owe them $7500 lol. So at this point I have paid off $2500 principle amount after paying them $7,900 over two years. I could cry. It’s disgusting.

When the loan agreement is signed does that mean I’m actually approved or just pre-approved?

Literally everything about Mogo is a scam. I have been trying to contact them for the last 4 days to try & get a response from ANYONE. All of them have ignored me. Guess why? Because I want to pay off my principal balance in FULL. They won’t respond because they would rather charge me $102.59 BIWEEKLY in interest. Scam artists at their finest. I literally have money sitting in my account to pay it off but nope, not good enough. Tried to do it through their stupid chatbot on their app, that’s suppose to take “2 days”. No money taken from my account. One person said (in the very beginning) to make a payment (this was after I set up the chatbot crap) manually. I declined because their chatbot was suppose to do it. Still hasn’t done it. Instead I got an auto email telling me they’re going to charge me for interest again. Bunch of liars! Every single one! And yet they’ll send it to collections if I don’t pay it??? Go away! At this point at least collections would take my money!!! Seriously debating it!

Is this even legal? They are offering a 1 year, $1000 loan with a 47.42 % annual interest rate

That is criminal!!!

The easiest way to get rid of this problem is to change your banking. Go to a different bank. Close your account and move to another bank. After that they can’t touch you. They’ll email threats but reply with “see you in court”… after awhile they’ll stop emailing you.

Done. Never again

Anonymous

I borrowed 400.00 from them about 10 years ago. I have been paying 18.00 a month for 10 years. Then they started taking another 68.00 from my account. Tried to contact them to settle it all. They couldn’t find me or my file. Put a stop payment through my bank 3 times and was still able to take my money. Had to close down my account completely. They emailed me and said they’ve closed my account but still continuously took from me. Now they’re trying to contact me in desperation. They are a fraud of a company. Stay away

Terrible company, very devious. They will lend you money at a ridiculous rate and make it very difficult for you to pay off anything but the principle unless you can do it in a lump sum, which defeats the purpose of a loan. If you want to increase your premium payments by a small amount, you have to notify them each and every time. It is also impossible to get in touch with an actual human. Very shady.