Unwrap portfolio with index mutual funds

The McEvers want to reduce their portfolio fees in order to save more for retirement.

The McEvers want to reduce their portfolio fees in order to save more for retirement.

With a paid-for home and six-figure portfolio, the couple’s friends think they have little to worry about. But “I do worry,” says Denise, who at 53 makes a good income as a dental hygienist. However, she enjoys no major benefits or employer-sponsored pension plan. Neither does Mark, 55, who lost his job in April 2011 and has worked only in contract positions since. They were investing $1,200 a month in RRSPs but ceased adding to Mark’s portion in November. The bank “wrap” program they’re invested in charges 2.5%. They’d prefer the lower fees of a “Couch Potato” but “don’t know how to do it ourselves.”

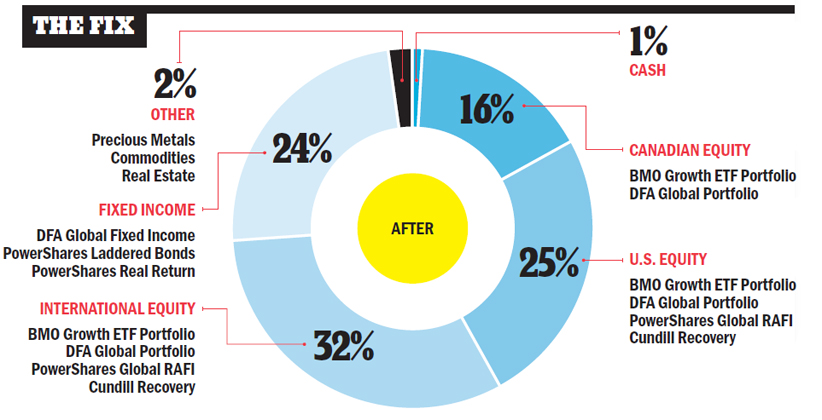

Financial planner Tony de Thomasis, of De Thomas Financial Corp., says the couple are moderate-risk investors and should be comfortable with an asset allocation of 75% equities to 25% bonds and cash. As retirement approaches and if markets cooperate, portfolios would be gradually rebalanced to raise the fixed-income weight by 8% every five years or so.

Financial planner Tony de Thomasis, of De Thomas Financial Corp., says the couple are moderate-risk investors and should be comfortable with an asset allocation of 75% equities to 25% bonds and cash. As retirement approaches and if markets cooperate, portfolios would be gradually rebalanced to raise the fixed-income weight by 8% every five years or so.

Rather than recommend an all-ETF portfolio, de Thomasis prefers index mutual funds that tilt portfolios toward small-cap and value stocks, such as those available from Dimensional Fund Advisors (DFA) or Invesco PowerShares. Also in the mix are BMO ETFs that provide more traditional large-cap equity exposure to the major North American stock indexes as well as some currency hedging to smooth out fluctuations between the U.S. dollar and Canadian dollar. He uses one actively managed mutual fund, Cundill Recovery, for much of the global stock exposure. For fixed income, he leans to shorter-term bond funds and floating-rate securities in order to lower the risk of spikes in interest rates and thus declining long-term bond prices.

De Thomasis believes the couple can cut their total investment management and financial planning costs to an all-in fee of 1.5%, while being subjected to less stress.

Since markets tend to move in three- to six-year cycles, de Thomasis would strive to rebalance the major asset classes whenever one strays 20% away from the target range, whether up or down.

Do you want a portfolio makeover from MoneySense? If so, send an email describing your situation to [email protected]

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email