The two-fund nest egg solution

This simple, low-cost dividend-paying portfolio is perfect for retirees

This simple, low-cost dividend-paying portfolio is perfect for retirees

THE PROBLEM

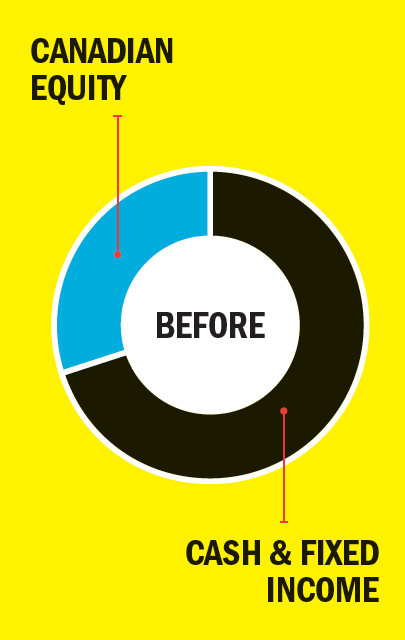

Jim Leppard, 58, recently retired from his government job with a defined benefit pension that covers his basic living expenses. But he’d like some extra income from his portfolio to pay for golf and skiing. Most of his holdings are in registered and non-registered accounts—mainly cash and fixed income, with 30% made up of high-fee Canadian equity mutual funds with management expense ratios (MERs) of up to 2.4%. A simple, conservative mix with a 4% net annual return is what he’d like instead. “I want to set-it-and-forget-it with one or two mutual fund or exchange-traded funds (ETFs) that pay dividends,” Jim says.

Jim Leppard, 58, recently retired from his government job with a defined benefit pension that covers his basic living expenses. But he’d like some extra income from his portfolio to pay for golf and skiing. Most of his holdings are in registered and non-registered accounts—mainly cash and fixed income, with 30% made up of high-fee Canadian equity mutual funds with management expense ratios (MERs) of up to 2.4%. A simple, conservative mix with a 4% net annual return is what he’d like instead. “I want to set-it-and-forget-it with one or two mutual fund or exchange-traded funds (ETFs) that pay dividends,” Jim says.

Investment adviser Andy Hammond of Hammond Financial agrees Jim needs a simpler, more cost-efficient approach for his retirement holdings.

Normally, he’d recommend a more aggressive portfolio for Jim because he has a good federal government defined benefit pension and an expected 30-year time horizon to draw down his funds. “But his risk tolerance is low, so it makes sense to keep his portfolio conservative—especially since his pension only covers his basic living expenses,” Hammond says. He suggests Jim split just two low-fee funds across all of his accounts.

Normally, he’d recommend a more aggressive portfolio for Jim because he has a good federal government defined benefit pension and an expected 30-year time horizon to draw down his funds. “But his risk tolerance is low, so it makes sense to keep his portfolio conservative—especially since his pension only covers his basic living expenses,” Hammond says. He suggests Jim split just two low-fee funds across all of his accounts.

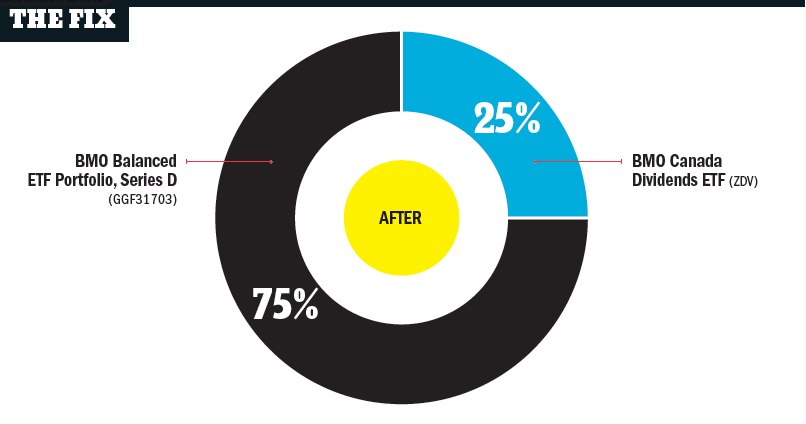

In the non-registered portion of his portfolio, Hammond advises that Jim put 25% of his overall assets into the BMO Dividend ETF, which has a low management expense ratio (MER) of 0.40%. This should provide enough cash flow for some travel every year, says Hammond. But just to be on the safe side, Jim should also set aside about $20,000 in cash to cover any unexpected travel costs over the next five years.

In the registered portion of his portfolio, Hammond says the remainder of Jim’s assets should go into the BMO Balanced ETF Portfolio (series D), which has an MER of 0.90%. “This fund holds bonds and equities and gives broad exposure globally.”

“A portfolio made up of these two ETFs will save Jim $1,000 in fees on every $100,000 he has invested compared to the two equity mutual funds he’s holding now,” says Hammond. “And as his non-registered account currently holds mostly cash, there will be no tax consequences.”

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email