Raining on the ‘All Seasons’ portfolio

The All Seasons portfolio was created by one of the largest hedge fund managers in the world

Advertisement

The All Seasons portfolio was created by one of the largest hedge fund managers in the world

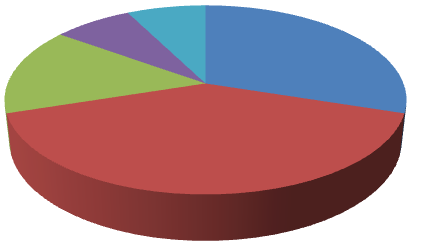

30% Stocks

40% Long-term bonds

15% Intermediate bonds

7.5% Gold

7.5% Commodities

In a backtest covering the 30 years from 1984 through 2013, the All Seasons portfolio had an annualized return of 9.7% (net of fees) and only four years with a loss. Its worst year was a modest–4% in 2008. With a risk-return profile like that, it’s no wonder so many investors have been attracted to the All Seasons portfolio. In fact, a service run by Robbins’ own advisor has been swamped with requests from investors who want a piece of this seemingly miraculous strategy.

So, is the All Seasons portfolio really a recipe for stellar returns with minimal risk? Or is it just another example of investors chasing hypothetical past performance?

30% Stocks

40% Long-term bonds

15% Intermediate bonds

7.5% Gold

7.5% Commodities

In a backtest covering the 30 years from 1984 through 2013, the All Seasons portfolio had an annualized return of 9.7% (net of fees) and only four years with a loss. Its worst year was a modest–4% in 2008. With a risk-return profile like that, it’s no wonder so many investors have been attracted to the All Seasons portfolio. In fact, a service run by Robbins’ own advisor has been swamped with requests from investors who want a piece of this seemingly miraculous strategy.

So, is the All Seasons portfolio really a recipe for stellar returns with minimal risk? Or is it just another example of investors chasing hypothetical past performance?

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email