Mortgage rate comparison tool

Customize the filters to compare rate types and terms.

Why trust us

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

5-year fixed rates in more detail

Five-year fixed-rate mortgages are generally the most popular type of mortgage in Canada. However, in the last few years, many Canadians have reassessed their mortgage options as a result of major changes in the economy, the real estate market and their personal finances. For example: In 2020, when interest rates fell to historic lows, more Canadians than usual opted for a variable mortgage rate to save on interest costs—a trend that reversed itself once rates began to rise again in March 2022. Here, you’ll find information on how five-year fixed mortgage rates are set, where they might go in the future, and how to find the best rate out there.

5-year fixed mortgage rate highlights

- Fixed mortgage rates are linked to the price of five-year government bonds. Rapid changes in Canada’s rate of inflation and the Bank of Canada’s benchmark interest rate, among other economic factors, have led to some volatility in bond yields, making it difficult to anticipate where fixed rates will go in the short-term.

- Historically, variable mortgage rates have trended below fixed rates. Currently, variable rates—which are tied to the central bank’s benchmark rate—remain above fixed rates.

Frequently asked questions about fixed rates

Got a question about your fixed rate mortgage? We have answers to the common questions Canadians have when it comes to this type of mortgage. Tap the + to read the answer.

The rate table at the top of this page provides up-to-date information on the best five-year fixed mortgage rates available today. As of March 12, 2025, 4.59% was one of the best fixed rates available for a mortgage with a down payment of less than 20%. For a mortgage with a down payment of 20% or more, the most competitive fixed rate was 3.94%. Bear in mind the rate you are offered will depend on the lender, size of your down payment, whether you need mortgage default insurance, and other factors related to your financial situation.

In early 2022, variable-rate mortgage holders saw their mortgage interest costs climb every time the Bank of Canada hiked its benchmark interest rate. Many variable-rate holders now have an interest rate higher than the fixed rates available to new borrowers today.

Before locking in your mortgage at a lower fixed rate, know that you generally have to pay a fee for breaking your original mortgage contract. (Our mortgage penalty calculator can help you estimate this cost.) By locking in a fixed rate, you also eliminate potential savings from a future drop in interest rates before the end of your current term. Switching to a fixed rate can be a good idea if you can no longer tolerate the risk of interest rate increases and need certainty regarding your future mortgage costs. Speak to a mortgage broker or financial advisor about what makes sense for you.

Fixed mortgage rates are based on what five-year government bond yields are selling at. Since the bond market functions like the stock market, a range of economic factors can influence bond prices—and by extension bond yields (the returns to bond investors). These factors include investors’ expectations regarding Canada’s rate of inflation and the Bank of Canada’s benchmark interest rate. (The policy interest rate is currently 2.75%.. Other factors: the strength of the job market and Canada’s unemployment rate, demand for safe investments over riskier investments, and the federal government’s credit rating (which reflects its ability to repay its debts).

Most observers, including Bank of Canada governor Tiff Macklem, are waiting to see how the U.S. federal government’s tariffs affect inflation in both the U.S. and Canada. The policy interest rate is currently 2.75%. Tariffs increase the price of goods, but if they usher in an economic contraction—already seen in the U.S. over the first quarter—inflation could come down. The trajectory of rates therefore will remain unclear until at least the second half of the year.

—Michael McCullough

How much does the average house cost in Canada?

According to the latest monthly affordability report from Ratehub.ca (Ratehub Inc. owns both Ratehub.ca and MoneySense), it became easier to qualify for a mortgage for the average-priced home in every market studied across Canada—a first since January. The recent Bank of Canada rate cuts are now making their way into consumer mortgage rates. The cumulative decrease of 225 basis points since June 2024 has brought Canada’s benchmark cost of borrowing from 5% to 2.75%. oIn addition to Canada’s prime rate lowering to 5.45%—which has in turn lowered variable mortgage rates—dropping bond yields have also pulled fixed mortgage rates down, with the new average five-year fixed rate falling to 3.99%.

Read the full article: How much income do I need to qualify for a mortgage in Canada?

Trending news in mortgages

Here are the top five trending mortgage articles on MoneySense.

Where are fixed mortgage rates going in 2025?

It’s difficult to predict where fixed mortgage rates will go in 2025. In early March 2025, the Government of Canada’s five-year bond yield fell to 2.63%, leading experts to predict further drops in fixed mortgage rates.

Signs that Canada’s economy was slowing (there always seems to be talk of a recession as of late), as well as indications that the Bank of Canada and the U.S. Federal Reserve could be done hiking interest rates, contributed to the decline in the Government of Canada’s bond yield. Other economic signals, including a rise in unemployment and a slowdown in consumer spending were also at play.

Where fixed interest rates will go in 2025 largely depends on the state of the economy at that time.

Why do fixed rates change? Economic indicators to watch

As mentioned above, the bond market functions similarly to the stock market; bond prices and yields change based on investor expectations and overall trends in the economy. Let’s take a look at two economic factors that influence the bond market, which in turn impact fixed mortgage rates.

The Bank of Canada’s benchmark interest rate

The BoC’s benchmark rate is a major driving force in the economy, helping to moderate inflation and/or stimulate economic activity as needed. It also leads the interest rates offered on many financial products, including high-interest savings accounts (HISAs) and guaranteed investment certificates (GICs). As a rule, bond prices and yields have an inverse relationship. So, when interest rates are low, bond prices increase—and bond yields fall. When bond yields fall, fixed mortgage rates will typically follow.

What is the current benchmark interest rate?

- On June 4, 2025, the Bank of Canada (BoC) held its benchmark rate at 2.75%. The next interest rate announcement will take place on Wednesday, July 10, 2025.

Canada’s rate of inflation

A high rate of inflation—as measured by the Consumer Price Index—suggests the economy is in overdrive. It means consumer prices and the overall cost of living are rising quickly, putting pressure on Canadians’ finances and cutting into the rate of return on investments. During periods of high inflation, investments offering fixed income (such as bonds) become less attractive to investors. It drives down bond prices, leading to higher bond yields. (Again, this is because bond yields and bond prices have an inverse relationship.) As a result, high inflation can lead to a jump in fixed mortgage rates.

What is Canada’s current rate of inflation?

- Canada’s annual rate of inflation, as measured by the Consumer Price Index (CPI), was 1.7% in April, down from 2.3% in March.

- May 2025 CPI data will be released on June 24, 2025.

The Bank of Canada looks to keep inflation at around the 2% mark, so if it continues to fall it raises the prospect of the BoC cutting the overnight rate again.

Watch: What is mortgage affordability?

A guide to fixed mortgage rates

- What is a five-year fixed mortgage rate?

- Should you switch from a variable- to a fixed-rate mortgage?

- How to compare five-year fixed mortgage rates

- How are five-year fixed mortgage rates determined in Canada?

- The pros and cons of five-year fixed rate mortgages

- Is a fixed-rate mortgage better?

- What happens when my mortgage term ends?

- Should you choose a five-year fixed mortgage rate?

- How fixed mortgage rates vary by province

What is a five-year fixed mortgage rate?

As the name implies, a five-year fixed-rate mortgage comes with a term of five years—that’s the duration for which your mortgage contract remains in effect. In Canada, mortgage terms can range from six months to 10 years, with five years being the most common.

With a fixed-rate mortgage, your mortgage interest rate is locked in for the period of the contract. This means you can plan for what your mortgage payments will be until your mortgage contract comes to an end and it’s time to renew.

For this reason, fixed-rate mortgages can provide a greater sense of security than variable-rate mortgages. With a variable-rate mortgage, the interest rate can fluctuate throughout the term. This flux occurs as lenders adjust their prime rates in response to changes to the Bank of Canada’s (BoC) overnight rate. The prime rate is currently 5.95%.

Finally, fixed-rate mortgages can be “open” or “closed.” An open mortgage comes with the option of making additional regular or lump-sum mortgage payments without penalty. These actions are financially penalized with a closed mortgage (though most include some options for prepayment). As a rule of thumb, closed-term mortgages come with lower interest rates because they offer less flexibility than open mortgages do.

How to compare five-year fixed mortgage rates

The mortgage rate tool at the top of this article provides a glance at the best mortgage rates offered by a swath of Canadian lenders. If you’re shopping for a mortgage to buy a new home, input the purchase price and your down payment amount to view the best mortgage rates available. You can further narrow your search by adding other filters, such as rate type, rate term, amortization, occupancy status, mortgage payment frequency and location of the property. Finally, the tool can also be used by existing mortgage holders to view the best rates for the following:

Mortgage renewal: If your mortgage term is ending soon, and you have an outstanding mortgage balance, you will have to renew your contract for another term. You can do this with your existing lender or a new one—but it’s always good to shop around for a better rate.

Mortgage refinance: If you want to break your current mortgage contract and negotiate a new contract, that’s called refinancing. You may want to do this to take advantage of lower interest rates or access equity in your home. However, the decision to refinance shouldn’t be taken lightly, because you could end up paying significant penalty fees.

Home equity line of credit (HELOC): This is a revolving line of credit, for a pre-approved amount of money, and it allows you to borrow from the equity in your home. The interest rates on HELOCs are usually lower than those for traditional lines of credit, but higher than those typically offered for variable-rate mortgages. The money borrowed through a HELOC is repaid, with interest, in addition to your regular mortgage payments.

Plan your next move with these mortgage calculators

How are five-year fixed mortgage rates determined in Canada?

Rates for five-year fixed mortgages are linked to three main factors:

- The price of five-year government bonds. Banks in Canada rely on bonds to generate stable profits and offset potential losses from the money they lend as mortgages. When banks and other mortgage lenders expect their bond profits to increase, they lower their fixed-mortgage rates, and vice versa.

Historically, fixed rates have tended to hover above variable rates; however there are a few instances when variable rates have surpassed fixed rates. This historical trend suggests buyers may end up paying more for fixed mortgages, especially during periods of falling interest rates. - Competition among lenders. When the real estate market is slow, mortgage lenders are more likely to offer discounted rates to entice home buyers. Smaller, less well-known lenders also tend to offer lower rates than established ones (like the Big Six banks).

- Your financial situation. Market rates aside, the rate that you may qualify for depends on your overall creditworthiness. If you have a high credit score and low debt servicing ratio, you’re more likely to qualify for a lower rate. The size of your down payment will also affect the rate offered to you by lenders.

The pros and cons of five-year fixed rate mortgages

Pros:

- Competitive rates: Mortgage lenders know you shop around, and they will generally try to offer comparable and lower rates for your business than what you’ve been quoted elsewhere.

- Predictability: You know your interest rate will not change for the duration of the term—same with your mortgage payments. That stability can help you budget more easily.

- Potential to save money: If interest rates increase during the term, you could end up paying less than you would with a variable rate.

Cons:

- Stiffer penalties: The penalty to get out of a fixed mortgage contract can be quite a bit higher than with a variable mortgage. You may also be more limited in your ability to pay off your mortgage faster through additional payments.

- Potential to pay more in interest: Historically, fixed rates have been priced higher than variable rates, with a few exceptions. In some instances, you could end up paying significantly more in interest than you would with a variable rate, if market interest rates fall during your term.

- Higher cost: You will pay for predictability and peace of mind. When comparing fixed to variable rates, you will see that fixed rates can be slightly higher.

Is a fixed-rate mortgage better?

Kim Gibbons, a mortgage broker with Mortgage Intelligence in Toronto, says both fixed and variable rates each have their benefits and their downsides, so it’s crucial for buyers to consider whether they value stability over potential savings.

“When my clients are trying to determine whether to go with a variable or a fixed rate, I tell them they need to really look at their risk tolerance and whether or not they have enough income or savings to provide a buffer to handle a sudden increase in rates,” she says. “If they are going to lose sleep at night, worried that interest rates are going to go up and they have a limited budget that they can’t go beyond, then a fixed rate is likely a better move for them. If, however, they have good incomes and a lot of savings put aside then they can better handle fluctuating rates.”

“It really depends on each person’s circumstances,” adds Gibbons. “There’s no single solution that’s right for everyone.”

What happens when my mortgage term ends?

When your mortgage term ends, your mortgage contract will be up for “renewal,” which is a new mortgage contract. A few months before it ends, your lender will send you a renewal statement that will include details on the remaining balance on your mortgage, your new interest rate at renewal, your payment schedule and any fees that may apply. At this time, you can choose to renew your mortgage with your current lender or do a comparison shop for a better rate from another lender.

No matter which lender you ultimately decide on, it’s always worth reviewing what five-year fixed mortgage rates are currently being offered in Canada before you renew or switch products or lenders.

Should you choose a five-year fixed mortgage rate?

When deciding if a fixed-rate mortgage or a variable-rate mortgage is right for you, there are a number of key factors to consider, including the historical performance of five-year fixed mortgage rates. Depending on what happens with market interest rates during your term, you may pay extra, but those additional costs could save you from the stress of predicting ups and downs in the economy and interest rates.

How fixed mortgage rates vary by province and territory

Mortgage rates in Canada are influenced by a complex interplay of factors, including overall housing demand and supply, regional housing markets, economic conditions, interest rates and lender competition. Currently, experts are predicting increased competition among mortgage lenders because more than half of all mortgages in Canada are expected to be up for renewal in the next two years. Furthermore, in an effort to meet revenue targets and acquire new clients, Canada’s Big Banks are offering increasingly attractive rates that make it harder for smaller mortgage brokers to compete.

Here’s a look at the rates you can expect to see across the country in some of the larger mortgage markets:

5-year fixed mortgage rates Quebec

3.94% to 6.69%

Quebec has a very competitive housing market (with the average home price increasing on average by to just over $500,000 in January 2025) due to its large population, resilient economy and continued steady population growth. Quebec homeowners also enjoy competitive mortgage options, supported by Canada’s Big Six banks, as well as the Laurentian Bank of Canada. Credit unions are also very popular (notably, Desjardins Group was founded in Quebec and is the largest credit union in North America).

5-year fixed mortgage rates Ontario

3.84% to 6.69%

The average price for a home in the province continues to grow, standing at $834,050 in January 2025. Thanks to its large population and high home values, Ontario has an active mortgage landscape, featuring the Big Banks, alternative and private lenders and credit unions.

5-year fixed mortgage rates for BC

3.84% to 6.69%

The province has the second largest number of mortgage holders in Canada, second only to Ontario, and also enjoys a competitive variety of lenders, from Big Banks to credit unions and alternative lenders.

Fixed mortgage rates for the rest of Canada

There are regional variations in mortgage competition based on supply and demand and local economic conditions. The rise of online mortgage platforms, however, means that smaller communities outside of Canada’s urban centers will continue to have better access to more competitive rates. Furthermore, with more than 50% of Canadian mortgages set to renew in the next two years, those looking for mortgages could enjoy more competitive rates across the country.

Here’s a look at the rates you can expect to see in three of Canada’s major markets:

5-year fixed mortgage rates for Montreal

3.94%

While the province of Quebec has a competitive mortgage ecosystem, it can be harder for homeowners to buy in Montreal due to significantly higher home prices versus the rest of the province ($709,200 in Montreal verus $501,300 in the province). However, Montreal does offer a Home Purchase Assistance Program that could help first-time home buyers.

5 year fixed mortgage rates for Vancouver

3.84%

Known for its expensive properties, competition is high amount mortgage lenders in this lucrative market.

5 year fixed mortgage rates for Toronto

3.84%

Toronto is Canada’s biggest real estate market and as such offers some of the most competitive rates.

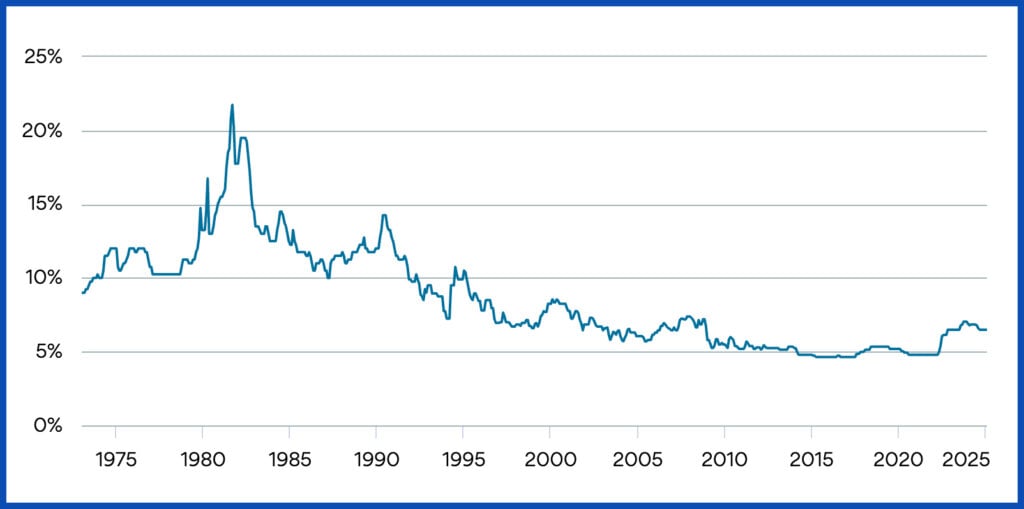

Historical 5-year mortgage rates

The state of Canada’s economy has always had a significant impact on mortgage rates here. Generally speaking, when inflation is high, the Bank of Canada will increase interest rates in an effort to slow buying and curb inflation. Lenders respond by increasing their loan and mortgage rates. If inflation and the economy is stagnating, the BoC will lower interest rates to increase borrowing and invigorate the economy. As lenders correspondingly drop their rates, it becomes more affordable to get a mortgage. This relationship can be seen clearly when looking at historical mortgage rates.

For example, in the 1970s, led by a global oil crisis and inflation averaging as high as 8%, the average prime rate offered by banks ranged from as low as 6% to as high as 12.90%, with the average 5-year fixed mortgage rate sitting at 11.20%. In the 1980s, the trend of high inflation and correspondingly high interest rates continued. At one point, in August of 1981, the five-year mortgage rate hit a whopping 21.75%. Thankfully the 1990s saw a gradual decline in inflation rates and the average 5-year fixed mortgage rate finally went into single digits after nearly two decades of steady double digits.

The early years of the 21st century saw a continuation in the downward trend in mortgage rates. Slow economic growth and the financial crisis of 2008 led to even further rate cuts. From a prime rate of 8.50% at the beginning of 2000 to a prime rate of 3.25% by the end of 2010, mortgage holders in Canada were enjoying an average 5-year fixed mortgage rate of 5.10%.

The trend of low rates continued into the 2020s, when, in an effort to stave off a recession during the pandemic, the Bank of Canada reduced its overnight rate to as low as .25% and banks posted prime rates of 2.45%, offering 5 year mortgage rates at 4.79%. However, in 2022, facing rising inflation the BoC began to aggressively hike rates, peaking at a policy rate of 5% in July of 2023. As inflation began to decline, the BoC began to once again reduce its policy rate, and as of March 2025, the rate is now 2.75%, with some banks predicting it could go as low as 2% by the end of the year.