How a falling loonie affects US equity ETFs

Trying to make currency plays is foolish at the best of times, but it’s especially unwise if you don’t fully understand how currency exposure works.

Advertisement

Trying to make currency plays is foolish at the best of times, but it’s especially unwise if you don’t fully understand how currency exposure works.

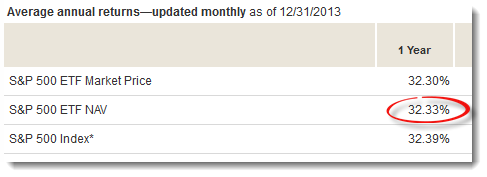

But as a Canadian investor, Gerry would have benefited from the appreciation in the US dollar, which rose about 6.29% in 2013. When calculated in Canadian dollar terms, his holding in VOO was up 40.65%.

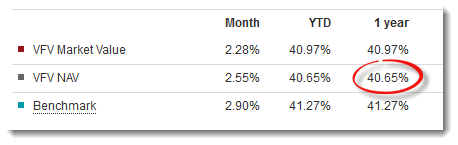

And if Sharon owned VFV, she would have visited Vanguard Canada’s website and found that her holding also returned 40.65% last year:

But as a Canadian investor, Gerry would have benefited from the appreciation in the US dollar, which rose about 6.29% in 2013. When calculated in Canadian dollar terms, his holding in VOO was up 40.65%.

And if Sharon owned VFV, she would have visited Vanguard Canada’s website and found that her holding also returned 40.65% last year:

So if you measure your returns in Canadian dollars, it makes no difference whether you use VOO orVFV. Their holdings—and therefore their exposure to USD—are exactly the same, even though the ETFs trade in different currencies.

So if you measure your returns in Canadian dollars, it makes no difference whether you use VOO orVFV. Their holdings—and therefore their exposure to USD—are exactly the same, even though the ETFs trade in different currencies.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email