Student credit cards are a specialized category of credit cards, designed for easy approval. No credit score? No income? No problem. That said, their easy qualification means you won’t get the same rewards and benefits as you would with a standard, unsecured credit card.

Student credit cards still have some great features though, so we’ve awarded our top picks and listed the best student credit cards for a variety of users. Take a look to see which card belongs in your wallet.

Featured credit cards

The best student credit cards in Canada

There’s an abundance of credit cards in Canada, but the options are a little more limited for students without a strong credit history and consistent annual income (both of which are common eligibility criteria). That’s not a bad thing—it can actually make it easier to narrow down a card based on your spending habits and goals.

| Category | Credit card | Annual fee | Who is it best for? |

|---|---|---|---|

| Cash back | BMO CashBack Mastercard | $0 | You spend the most on groceries, and you prefer money back over travel points. |

| Travel | CIBC Aeroplan Visa Card for Students | $0 | You have your mind on a travel destination and need a cheap flight to get you there. |

| Low-interest | Flexi Visa | $0 | You don’t expect to pay off your credit card balance every month. |

| Secured card | Home Trust Secured Visa | $0 | Your main goal is to build a credit history. |

| Store card | PC Mastercard | $0 | You spend a lot of money on groceries, and it’s almost always at a Loblaws-owned store. |

| Entertainment | Scotiabank Scene+ Visa Card for students | $0 | You love the big screen and want flexible rewards. |

Best student cash back card: BMO CashBack Mastercard

Card type: Unsecured

Minimum income requirement: N/A

The BMO CashBack Mastercard is a top choice for students looking for easy cashback earnings. Combining no annual fee with an impressive 3% cashback rate on grocery purchases, this card offers students a chance to earn cash rewards in a high-spend category. Plus, you can get up to 7 cents off per litre at Shell stations.

BMO CashBack Mastercard

Annual fee: $0

- 3% cash back on groceries

- 1% on recurring bills

- 0.5% on everything else

Welcome offer: Earn up to 5% cash back in your first 3 months. Conditions apply.

Card details

| Interest rates | 21.99% on purchases, 23.99% on cash advances, 23.99% on balance transfers |

| Income required | None specified |

| Credit score | None specified |

Pros

- Highest cash back rate for groceries among no-fee credit cards in Canada at 3%

- Cash back redemption any time—apply it as a statement credit, add it to your BMO InvestorLine account, or deposit it into your BMO chequing or savings account

- Discounts on select rental cars and Cirque du Soleil shows

- Gas savings at Shell stations

- Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.

Cons

- Low monthly cap of $500 on groceries and recurring bills (both boosted earning categories)

- Low 0.5% base earn rate—lower than other student cashback card

- Convenience stores, bakeries, and other specialty food shops excluded from the grocery category

Best travel credit card for students: CIBC Aeroplan Visa for Students

Card type: Unsecured

Minimum income requirement: N/A

The CIBC Aeroplan Visa Card is tailored to the needs of students—especially those who can take advantage of travel rewards. You’ll earn 1 point per $1 spent on gas, EV charging, Air Canada purchases, and groceries. This card also starts you off with bonus Aeroplan points and provides a free SPC+ membership that lets you enjoy savings of up to 30% across 450-plus brands.

CIBC Aeroplan Visa Card for Students

Annual fee: $0

- 1 point per $1 spent on gas and EV charging, groceries and Air Canada purchases

- 0.67 points per $1 on everything else

Welcome offer: earn 10,000 Aeroplan points when you make your first purchase ($200 value)

Card details

| Interest rates | 20.99% on purchases and 22.99% on cash advances (21.99% in Quebec) |

| Income required | None specified |

| Credit score | None specified |

| Point value | . |

Pros

- Lower earn rate than other cards, but Aeroplan points often worth if you redeem them for travel

- Redeem points for any Air Canada seat—no blackout dates and ability to pay with mix of points and cash

- Premium services when you fly with AIr Canada

- Some travel insurance included, such as CDW/LDW for car rentals, purchase security, and extended protection insurance

Cons

- No Status Qualifying Miles on your everyday purchases

- Limited value if you don’t travel frequently via Air Canada or one of its partner airlines

- Limited insurance compared to other Visa cards

Best low-interest credit card for students: Desjardins Flexi Visa

Card type: Unsecured

Minimum income requirement: N/A

While you won’t earn rewards with this card, the Flexi Visa from Desjardins stands out as a low-interest, no-fee credit card for students looking to minimize credit card debt. It also features benefits like mobile device coverage and some travel insurance, rental car discounts, and a monthly installment payment plan on eligible purchases.

Desjardins Flexi Visa

Annual fee: $0

Rewards: Does not offer rewards.

Welcome offer: None at this time.

Card details

| Interest rates | 10.90% on purchases and 12.90% on cash advances |

| Income required | Not specified |

| Credit score | Not specified |

Pros

- Lowest regular purchase interest rate for a no-fee card

- $5 million in emergency medical coverage for trips up to three days, plus trip cancellation and baggage coverage

- Purchases of $200 or more with participating merchants eligible for installments

Cons

- No welcome bonuses or promotions

- Physical branches limited to Ontario and Quebec

- No rewards program earn

Best secured credit card for students: Home Trust Secured Visa

Card type: Secured

Minimum income requirement: N/A

The Home Trust Secured Visa is an effective tool for young Canadians trying to establish or rebuild their credit history. And since it’s a secured card, approval is guaranteed. You set your own spending limit—which can range from $500 to $10,000—by providing a security deposit. The card has two interest rate options: 19.99% with no annual fee or 14.90% with a $59 annual fee. We like that this card lets you choose, but we recommend the low-rate option.

Home Trust Secured Visa

Annual fee: $0

Rewards: Does not offer rewards.

Welcome offer: None at this time.

Card details

| Interest rates | 19.99% on purchases and 19.99% on cash advances |

| Income required | None specified |

| Credit score | 300 or higher |

Pros

- Virtually guaranteed approval

- Reports spending habits to both credit monitoring bureaus, which can help build your score

- Credit limit of up to $10,000 depending on your security deposit

- Option to choose a lower interest rate with a modest annual fee.

- Compatible with digital wallets like Apple Pay, Google Pay, and Samsung Pay

Cons

- No rewards on spending (typical for secured cards)

- Minimum security deposit of $500

- Card not available to residents of Quebec

Best store credit card for students: PC Mastercard

Card type: Unsecured

Minimum income requirement: N/A

If you’re a student, a lot of your budget is probably going to grocery stores. When you use a PC Mastercard, you’ll earn 1% back in points at Lobalaw-brand grocery stores, 2.5% back in points at Shoppers, and 1% back in points at Joe Fresh, dining, transit, and everywhere else. Plus, you’ll get at least 3 cents per litre back in points for your Esso and Mobile fuel purchases.

PC Mastercard

Annual fee: $0

Welcome offer: Earn 20K points when you spend $50 or more at participating stores within 60 days of account approval.

- 25 points per $1 spent at Shoppers Drug Mart

- At least 30 points per litre at Esso and Mobil gas stations

- 10 points per $1 on everything else

Card details

| Interest rates | 21.99% on purchases, 22.97% on cash advances and % on balance transfers |

| Income required | None specified |

| Credit score | 560 or higher |

| Point value | 1 PC Optimum point is worth $0.001 (redeem 10,000 points for $10) |

Pros

- Earns a generous rate of return on grocery, drugstore, dining, and transit purchases.

- Easy to redeem PC points at Loblaw banner stores, which includes 4,500+ locations across Canada.

- There’s no cap on how many PC Optimum points you can earn.

Cons

- PC points aren’t as versatile as cash back rewards

- Must redeem a minimum of $10 at a time

- Relatively high standard purchase interest rate of 21.99%

Best student credit card for entertainment: Scotiabank Scene+ Visa for Students

Card type: Unsecured

Minimum income requirement: $12,000

It’s probably no surprise that a card that participates in the Scene+ rewards program is the best entertainment card. The Scotiabank Scene+ is a student’s go-to card for earning increased points at Sobeys, Safeway, Home Hardware, and Cineplex that can be used for movie tickets and concessions, travel, Apple and Best Buy merchandise, and so much more. It’s easy to earn points and even easier to spend them.

Scotiabank Scene+ Visa card

Annual fee: $0

- 2 Scene+ points for every $1 spent at Sobeys banner stores and Cineplex

- 1 Scene+ point for every $1 spent everywhere else

Welcome offer: Earn up to 10,000 bonus Scene+ points within the first 3 months. Offer ends July 1, 2026.

Card details

| Interest rates | 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers |

| Income required | $12,000 per year |

| Credit score | 660 or higher |

| Point value | 1 Scene+ point = $0.01 when redeemed for travel, store purchases and food and drink at Cineplex and Scene partners |

Pros

- Scene+ is one of the most versatile points programs

- Redeem points for movie tickets and concessions, restaurants, travel, statement credits, groceries, Apple and Best Buy merchandise, and gift cards

- No fee and offers rewards on all purchases

- Save 25% off base rates for car rentals at participating Avis and Budget rental locations in Canada and the U.S.

Cons

- No included insurance coverage—not even basic purchase protection

- Minimum income requirement of $12,000 per year

To select the best cards for students, we evaluated several key factors that are important when choosing a new card. First, we considered approval likelihood, paying special attention to annual income requirements. We also looked at annual fees to select cards that were within reach of most students. The addition of links from affiliate partners has no bearing on the results in this ranking. Read more about the MoneySense selection process and about how MoneySense makes money.

Compare all student credit cards

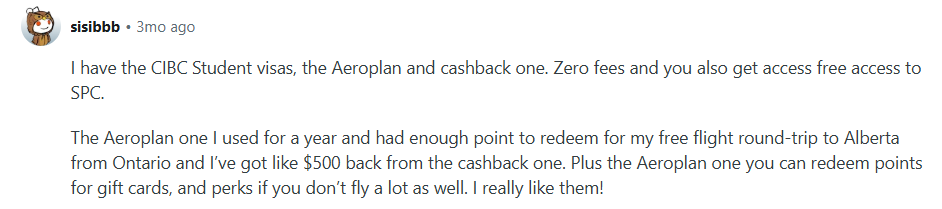

Reddit reviews: Which credit cards do Canadian students love?

Sometimes, reading reviews from real cardholders can help if you’re on the fence about which card is right for you.

One card that stood out in Reddit threads was the CIBC Aeroplan Visa card, which one user highly recommended.

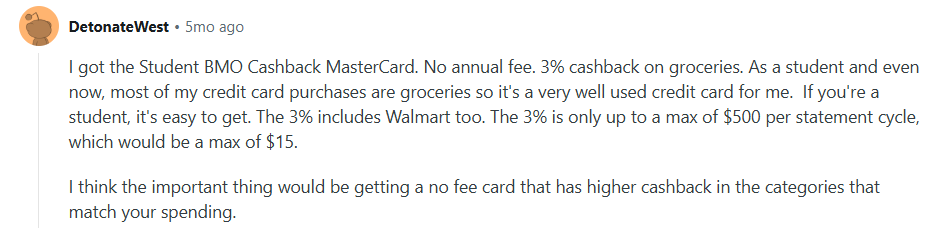

As another Redditor pointed out, the best student credit card for you will be the one that matches your spending habits.

It’s worth mentioning again that you’ll probably want to stick with a no-fee (or at least low-fee) card since you’re probably on a tight budget and shouldn’t be paying hefty fees just to use a credit card.

Types of student credit cards

Not all student cards are created equal, so before you apply for one, take some time to figure out the right one(s) for you.

- Cash back student credit cards: These cards earn you a percentage of your purchase in cash back, which is usually given as a statement credit. Some cards pay out cash back on demand, while others only award it once per year.

- Low-interest student credit cards: If you know you’ll be carrying a credit card balance from month to month, a card with a low interest rate can save you money in the long term. Since the average credit card interest rate is around 20%, anything below this can be considered a low-interest card.

- No-fee student credit cards: We should be clear that no fee doesn’t mean no interest rates or fees for late payments, overdrafts, etc. No-fee credit cards don’t charge an annual fee, which makes them great options for students on limited budgets.

- Student travel credit cards: Instead of prioritizing cash back, travel credit cards allow you to earn points or miles that you can redeem for flights, hotels, and travel upgrades like priority check-in.

- Rewards student credit cards: These are some of the most flexible student cards because they allow you to decide how to use the rewards you earn on purchases. Redemption options may include gift cards, merchandise, charitable donations, travel, or even financial products.

Note that some cards fall into multiple categories—like no-fee rewards credit cards.

Pros and cons of student credit cards

Now that you know what student credit cards are, it can help to highlight their best features (and potential drawbacks).

Pros

- You’re more likely to qualify for a student credit card than for another unsecured credit card

- Using a student credit card responsibly can help you build a solid credit score

- Managing your student credit card can help you learn to manage your finances

- Depending on the card, you may get rewards, discounts, or insurance coverage

Cons

- It’s easy to spend more than you intend to with a credit card—budgeting can be easier with a debit card

- If you go over your limit or miss payments, you could damage the credit score you’re hoping to build

- You’ll typically have a low credit limit, which can help you stay on budget but makes it hard to make larger essential purchases

- Student credit cards don’t offer as much value as a traditional unsecured credit cards

Should you get a student credit card?

Just because you’re a student doesn’t mean you have to get a credit card. In fact, applying for your own credit card can be a big step and you should only consider it if you’re diligent with your finances.

Another option you have is to become an authorized user, usually on your parent’s or partner’s credit card account. If they add you, you’ll get your own credit card that’s tied to their account (and credit limit).

While it’s much easier to become an authorized user, it may not help build your credit score. Not all card issuers report authorized user activity to the credit monitoring bureaus—they typically only report the primary cardholder’s payments.

The bottom line: If you know you can stay on top of your spending and you’d like to begin building a credit score, getting a student credit card can be a smart move.

How to make the most of a student credit card

1. Check your payment due dates

You probably know that credit card bills arrive every month, but that doesn’t mean the due date for your payment is immediate. The date that begins your billing cycle depends on when you are approved for the account, and it could be any day of the month. Make note of the due date and prioritize paying your credit card bill on time. Consider adding these dates to your school calendar, too.

2. Pay off your balance in full

If you’re going to be responsible with your credit card, you won’t use it to spend money you don’t have. It’s best practice to pay off your bill in full, on time, every month. Not only will this boost your credit score, but it will also help you avoid costly interest charges.

3. Heed the minimum payment

If you do overspend, you will still need to pay off some of your balance. Your bill will show a total balance and a minimum payment. You must pay at least the minimum payment on time and every month, no matter what. Missing payments is one of the worst things you can do for your credit score. But remember: paying only the minimum means that you’re accumulating interest on the unpaid balance. At an average of around 20%, this can add up quickly.

4. Don’t max out your credit card

Your credit card will have a credit limit; that’s the total amount of money you can technically borrow. But spending all the way up to your limit—that is, maxing out your card—is reckless if you can’t pay it off in full each month. Use your card selectively for smaller purchases, at least initially, and consider using debit for almost everything else.

Featured credit cards

Scotiabank Passport™ Visa Infinite Card

SimplyCash Preferred Card from American Express

MBNA True Line Mastercard credit card

FAQs

There’s not one specific bank that’s best for a student credit card. In fact, many students prefer to get a credit card from a bank they already have a chequing or savings account with so it’s easier to make credit card payments.

If there’s only one thing you remember about using a credit card, it should be this: Always pay your credit card balance in full. This way, you avoid paying interest, late payments, or over-limit fees.

No, as long as your credit card is in good standing, it won’t damage your score. It’s still a good idea to make an occasional charge and pay it off so your card issuer doesn’t cancel it, though.

Your card isn’t cancelled or revoked after you graduate. You’ll be able to use it as long as you like. That said, as your credit score and income grow, you might consider a card that offers you better benefits and rewards.