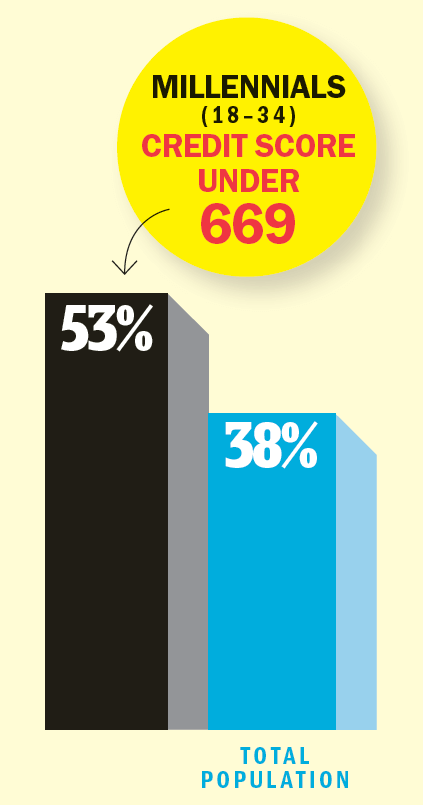

Credit card mistakes millennials are making

Don't miss out on the opportunity to start building a credit history

Advertisement

Don't miss out on the opportunity to start building a credit history

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email