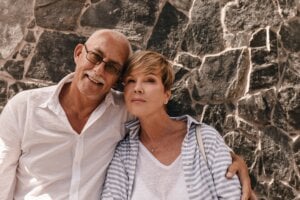

We’re 10 years apart. Can we retire together?

Retirement planning for couples with a significant age difference calls for realistic projections but also flexibility.

Advertisement

Retirement planning for couples with a significant age difference calls for realistic projections but also flexibility.

Short answer: Yes. But to take advantage of this amazing tax shelter, you need to understand the CRA’s rules...

Many investors disparage bonds—with good reason. You have to determine what problems these investments solve and whether there are...

Under what circumstances can you obtain the greatest tax savings on this $2,000 credit?

Different retirement income strategies using registered accounts produce different outcomes. You must pick your priorities.

Ontario heirs face a huge tax bill after their parents’ deaths—highlighting the importance of planning ahead to reduce taxes...

A financial planner explains some tax-saving strategies that Canadian retirees may not have thought of.

It matters how you designate a spouse on your TFSA should you die before they do. Successor holders get...

The Index Matrix vividly illustrates how different assets performed in the past. Here’s how Canadians can use it to...