One of the best reasons to reach for a credit card instead of cash is the fact that you can earn cash back, effectively getting a discount on every purchase. While the amount you get for each transaction is usually small—only a few percent of the purchase cost—these little cashback amounts really add up, especially with the right card.

The best cashback credit card for you depends a lot on where you shop and how you prefer to earn cash back. To help you find that card, MoneySense curated this list of the best cashback credit cards in Canada so you can start earning right away.

What is the best cashback credit card in Canada?

The best cashback card is a competitive field, but we’ve chosen gold, silver, and bronze winners. Take a look to see which card best matches your spending habits.

SimplyCash Card from American Express

CIBC Dividend Visa Infinite Card

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings of major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Gold: Rogers Red World Elite Mastercard

The Rogers Red World Elite Mastercard is the best cashback credit card in Canada, offering a high earn rate of 1.5% on all purchases, so there’s no need to strategize spending by maximizing bonus categories. Plus, the accelerated rate of 3% on all U.S. purchases is enough to cover foreign transaction fees. This card also provides exceptional travel perks, including airport lounge access, emergency medical, and trip cancellation insurance—all without an annual fee.

Rogers Red World Elite Mastercard

Annual fee: $0

- 3% cash back on all U.S. dollar purchases

- 1.5% on all other purchases (2% for Rogers, Fido and Shaw customers)

Welcome offer: None at this time.

Card details

| Interest rates | 25.99% on purchases, 27.99% on cash advances, 27.99% on balance transfers |

| Income required | $80,000 per year |

| Credit score | 725 or higher |

Pros

- Solid rewards: Earn 1.5% on all purchases made in Canada. And as a Mastercard, this is one of the best cards to use at Costco, which doesn’t accept Visa or American Express.

- Rogers, Fido, and Shaw customers earn more: Customers get 2% cash back on all purchases (instead of the standard 1.5%). Plus, when you redeem cash back on your Rogers, Fido, or Shaw account, the rewards are worth 1.5x more. For example, $100 in cash back becomes $150 when applied to a Rogers bill.

- Save on roaming fees: The card comes with five annual Roam Like Home days at no cost for Rogers mobile plans (an $80 value).

- Great for U.S. shopping: Earn 3% cash back on purchases in U.S. dollars, which offsets the typical 2.5% foreign transaction fee.

- No annual fee: This is unique among World Elite Mastercards in Canada.

- Flexible redemptions: Redeem rewards against purchases on your card for as little as $10.

Cons

- High income requirement: As a World Elite Mastercard, the eligibility requirements of $80,000 personal or $150,000 household might put it out of reach for some Canadians.

Silver: CIBC Dividend Visa Infinite

The CIBC Dividend Visa Infinite offers high earn rates on everyday purchases. You won’t find a better rate on groceries rewards or gas rewards (which includes EV charging spends), making it one of the highest cash rewards credit cards around. Plus, you can redeem your cash back anytime and save at the pump with exclusive fuel discounts.

CIBC Dividend Visa Infinite

Annual fee: $120 (rebated first year)

- 4% cash back on eligible gas, EV charging and grocery purchases

- 2% on dining, daily transit and recurring payments

- 1% on everything else

Welcome offer: Join and earn over up to $400 in value including a first year annual fee rebate. Offer not available to Quebec residents.

Card details

| Interest rates | 21.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers |

| Income required | Personal income of $60,000 or household income of $100,000 |

| Credit score | 725 or higher |

Pros

- Broad spending categories: Enjoy boosted rewards on more purchases, including transportation, which includes taxis, ride sharing and public transit.

- Fuel discounts: Link your card with Journie Rewards and save 3 cents per litre at Pioneer, Fas Gas, Ultramar, and Chevron gas stations. Get an additional 7 cents off per litre every time you reach 300 Journie Rewards points.

- Flexible redemptions: Get your cash back whenever you need it rather than as an annual statement credit.

Cons

- Mediocre base earn rate: 1% is pretty standard for a minimum earn rate, but it’s still lower than other top cashback cards.

- High income requirement: With annual requirements of $60,000 personal or $100,000 household, this card has a higher barrier to entry than some options..

Bronze: Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card is one of the most flexible cashback credit cards on the market, allowing you to pick up to three 2% bonus categories of your choice from a list of 10. Better yet, you can change your categories as needed (with 90 days’ notice).

Tangerine Money-Back Credit Card

Annual fee: $0

- 2% in up to 2 categories of your choice (including groceries, gas and dining) or 3 categories if you deposit your Rewards into a Tangerine Savings Account and get a third 2% Money-Back category.

- 0.5% cash back on everything else

Welcome offer: Earn an extra 10% cash back during the first two months (up to $100 in cash back). Offer expires January 30, 2026

Card details

| Interest rates | 20.95% on purchases, 22.95% on cash advances and 22.95% on balance transfers |

| Income required | Personal or household income of $12,000 |

| Credit score | 660 or higher |

Pros

- Customizable bonus categories: Pick two bonus categories for unlimited 2% cash back, and get a third 2% category by automatically depositing your earnings into a Tangerine account. Change your categories any time with 90 days’ notice.

- Free supplementary cards: Maximize cashback earnings by adding an authorized user at no added cost.

- Monthly redemptions: Rewards are paid out monthly, rather than annually, so you can use your cash back quicker.

- Low income requirement: This card only requires an annual income of $12,000—but you’ll still need to have a good credit score for the best approval offs.

Cons

- Limited insurance coverage: This cash back card only offers two of the most basic insurance coverages, purchase assurance and extended warranty.

MoneySense editors apply their credit card expertise and knowledge of Canadians’ financial goals to come up with selection criteria that matches the needs of the intended cardholder, including local and international travellers. For this series of the best travel credit cards in Canada, your return on spending is a key consideration, because it represents the value of the points you earn with every purchase, which can be earned or redeemed from travel purchases. For Canadians, we consider annual fees and eligibility criteria (for student credit cards), perks and insurance (for premium credit cards) and other factors, specific to each travel card category. The addition of links from affiliate partners has no bearing on the results in this “best travel credit cards in Canada” ranking. Read more about the MoneySense selection process and about how MoneySense makes money.

Compare all cashback credit cards

Other top cash back credit cards

These may not have made it into our top three cashback cards, but they’re still excellent picks to consider for your wallet.

Best American Express: American Express SimplyCash Preferred

The American Express SimplyCash Preferred offers impressive earn rates on grocery and gas purchases, two of the most-used spending categories. It also has the highest base earn rate in Canada at 2%. Combined with solid insurance coverage, access to Amex benefits, and free supplementary cards, this is a strong option for those who want an Amex card (and all the perks that come with one).

Amex SimplyCash Preferred

Annual fee: $119.88 ($119 for Quebec residents)

- 4% cash back on eligible gas and grocery purchases

- 2% cash back on everything else

Welcome offer: Earn a bonus 10% cash back on all purchases for your first three months (up to $2,000 in purchases) and a $50 statement credit when you make a purchase in month 13 (total value of up to $250).

Card details

| Interest rates | 21.99% on purchases and cash advances, 25.99% to 29.99% penalty APR on purchases and cash advances (rates are variable) |

| Income required | None specified |

| Credit score | 725 or higher |

Pros

- Generous earn rates: Get 4% cash back on gas and groceries and a strong 2% cash back on all other purchases.

- No income requirement: This cash back card has no minimum income requirement—but you’ll still need a good credit score..

- Exclusive Amex perks: Perks for Amex cardholders include dining and retail experiences, Amex Front of the Line event access, and tailored monthly Amex Offers.

- Free supplementary cards: Maximize your cash back by adding an authorized user to your account.

Cons

- Limited acceptance: Amex is not as widely accepted as Visa or Mastercard, and you can’t use an Amex card at Costco or Loblaws stores.

- Yearly redemptions: Cash back is issued as a statement credit just once per year in September.

Best for everyday spending: BMO CashBack World Elite Mastercard

The BMO CashBack World Elite Mastercard has a solid variety of extra-earn categories that are targeted to everyday spending like groceries, transit, and gas. Unfortunately, some cardholders may find the monthly spending caps quite low for each category, which can significantly impact potential earnings. Nonetheless, the card can give you strong cashback earnings and comes with some unique perks, including free roadside assistance.

BMO CashBack World Elite Mastercard

Annual fee: $120 (waived first year)

- 5% cash back on groceries

- 4% back on transit

- 3% back on gas and electric vehicle charging

- 2% on recurring bill payments

- 1% back on everything else

Welcome offer: Earn up to $335 in additional cash back, including 10% cash back during your first 3 months.

Card details

| Interest rates | 21.99% on purchases, 23.99% on cash advances, 23.99% on balance transfers (21.99% in Quebec) |

| Income required | Personal income of $80,000 or household income of $150,000 |

| Credit score | 760 or higher |

Pros

- Variety of boosted categories: You’ll earn the most cash back for groceries, but transit, gas, and recurring bills also have increased earn rates.

- Free roadside assistance: This service includes battery boosts, fuel delivery, locksmith services, towing, and flat-tire changes.

- Extensive insurance coverage: You’ll enjoy 13 types of insurance coverage, including emergency medical, trip cancellation, hotel burglary, and more.

- On-demand redemption: You won’t have to wait until your card’s anniversary to receive a cash back statement credit.

- Instacart offer: Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.

Cons

- Low monthly spending caps: Although the card boasts impressive earn rates, you’ll only enjoy them up to the first $300 or $500 in monthly spending (depending on the category).

- Steep income requirements: High income requirements of $80,000 personal or $150,000 annual household income might put this card out of reach for some Canadians.

- No free lounge passes: The complimentary Mastercard Travel Pass provided by DragonPass membership does not include any free lounge visits. You must pay a fee of USD$32 per visit.

Best for boosted earn rates: Neo World Elite Mastercard

Let’s start by talking about the card’s base earn rates: 5% cash back on groceries, 4% back on recurring bills, 3% back on gas and EV charging, and 1% back everywhere else. But if you have a Neo Everyday account with at least $5,000 in it, you’ll earn 6%, 4.5%, 3.5%, and 1% respectively. Keep at least $10,000 in the account and you’ll earn even more.

Neo World Elite Mastercard

Annual fee: $125

Interest rates: 9.99% to 29.99% on purchases, 22.99% to 28.99% cash advances

Earn rate: 5% cash back on grocery purchases; 4% on recurring expenses; 3% on gas and EV charging; and 1% on all other purchases

Welcome offer: None

Annual income requirement: Personal income of $80,000 or household income of $150,000

Pros

- Cash back on demand: You won’t have to wait until your card’s anniversary to receive a cash back statement credit.

- Extensive insurance coverage: You’ll enjoy 13 types of insurance coverage, including emergency medical, flight delay, and rental car coverage.

- World Elite Mastercard benefits: Enjoy premium perks like concierge service, Priceless Events, Mastercard Travel Rewards, and more.

Cons

- Steep income requirements: High income requirements of $80,000 personal or $150,000 annual household income might put this card out of reach for some Canadians.

- Low monthly spending caps: This card offers impressive earn rates, but they’re capped at the first $500 to $1,000 in monthly spending (depending on the category).

- No welcome bonus: Most premium credit cards—including other World Elite Mastercards—offer a nice welcome bonus to get you started, but the Neo card does not.

Best for students: BMO CashBack Mastercard

It’s not often you get high cash back rates with a free card, but the BMO CashBack Mastercard provides just that. Combining no annual fee with an impressive 3% cash back rate on grocery purchases, this card is perfect for students looking to earn cash rewards in a high-spend category.

BMO CashBack Mastercard

Annual fee: $0

- 3% cash back on groceries (on the first $500 per month)

- 1% on recurring bills

- 0.5% on everything else

Welcome offer: Exclusive Offer: Get up to 5% cash back in your first 3 months. Plus, a $50 cash back bonus that’s up to $175 in cash back in your first year.

Card details

| Interest rates | 21.99% on purchases, 23.99% on cash advances, 23.99% on balance transfers |

| Income required | n/a |

| Credit score | None specified |

Pros

- 3% back on groceries: This rewards credit card offers the highest cashback rate for groceries among no-fee credit cards in Canada.

- Flexible redemptions: You can redeem your cash once you accumulate as little as $1 in earnings. Apply it as a statement credit, add it to your BMO InvestorLine account, or deposit it into your BMO chequing or savings account.

- Extra perks: Enjoy discounts on select rental cars and Cirque du Soleil shows.

- Instacart offer: Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.

Cons

- Earning caps: There is a monthly earning cap of $500 on groceries and recurring bills—though that cap may be sufficiently high for a student. If you spend more, you’ll earn at the low 0.5% base rate.

- Narrow spending categories: Shops like convenience stores, bakeries, and other specialty food markets are excluded from the grocery category, so you won’t earn boosted rewards on those purchases.

Best for dynamic spending categories: CIBC Adapta

This card has an unusual rewards system: you’ll earn 1 Adapta point per $1 on all purchases across 12 categories like gas, groceries, dining, clothes, hotels, and health—but you’ll earn an additional 50% back in your top three spending categories for the month. There’s no need for you to select high-earning categories since the card automatically rewards your highest spending.

Pros

- No annual fee: As the only other no-fee credit card on our cash back list, all rewards you earn are simply money in your pocket.

- Fuel discounts: Save up to 10 cents per litre on fuel at Journie Rewards stations.

- Roadside assistance: Enjoy peace of mind with roadside assistance from Dominion Automobile Association. Services include fuel delivery, towing, battery assistance, and more (valued at $50).s.

Cons

- Limited redemption options: You’ll get the best value when redeeming points for select CIBC financial products instead of statement credits.

- Limited insurance coverage: This card only includes two types of coverage—extended warranty and purchase protection.

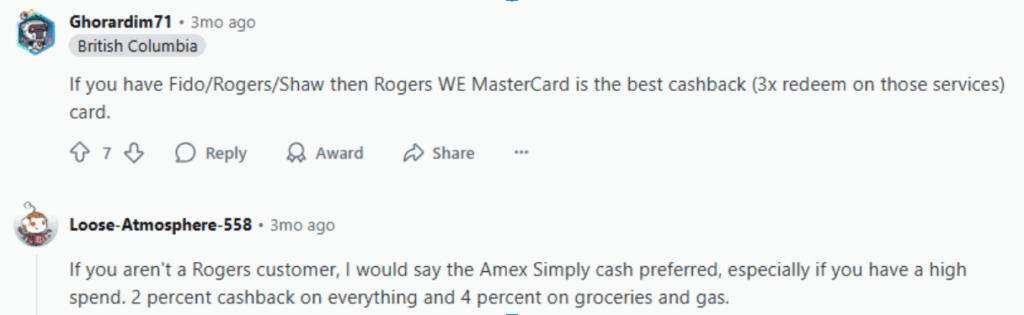

Reddit reviews: The best cashback credit cards according to Canadian cardholders

We checked Reddit to see what actual cardholders had to say about the best cash back card options. Our Gold choice, Rogers World Elite Mastercard, proved popular.

However, as one user pointed out, the best cash back card for you really depends on your personal spending habits.

How cashback credit cards work

It’s easy to use a cashback card—just swipe, tap, or insert it when making a payment and a percentage of that payment will be credited back to you later. For instance, if you have a 2% flat-rate cashback card and spend $100, you’ll receive $2 cash back for that purchase on your next statement.

Depending on your credit card, you can either redeem your cash whenever you like or you may receive the credit on your card’s anniversary.

3 types of cashback credit cards in Canada

Flat rate cards, like the Rogers Red World Elite Mastercard, offer a base rate of return. For instance, you’ll earn a flat 1.5% cash back across all purchases. This type of earning structure is the simplest, so it’s a great option for people who don’t want to make decisions about which card to use for which purchase. You’re also guaranteed a set cash back return against all your purchases, not just specific categories of spending.

Tiered credit cards, like the BMO CashBack World Elite Mastercard, give different cashback rates depending on the spending category. So, you might earn 5% cash back on groceries, 4% back on transit, 3% back on gas, 2% back on recurring bills, and 1% back on everything else. Matching a credit card with tiered earn rates to your shopping habits can help you maximize your cash back.

Some cards don’t fit neatly into the flat or tiered cash back category. The value of these customized or dynamic cashback cards changes. For instance, with the Tangerine Money-Back card, you choose two (or three) spending categories that earn 2% cash back and all other purchases earn 0.5%. Plus, you can change your boosted categories every 90 days. Or there’s the CIBC Adapta, which earns a base 1 point per $1 on all purchases, but rewards your three highest spending categories with a 50% bonus at the end of the month.

How to choose a cashback credit card

It’s easy to go with the cashback card offered by your current bank, but that’s not always the best choice. Take the time to compare your options to identify the card that delivers the highest return based on your spending habits and lifestyle. Decide if you want a flat rate card, one that has tiered cash back rates, or a card that allows you to change bonus cash back categories.

Remember: You don’t need to open a chequing or savings account with a bank to get a credit card from there, and you can pay your bill electronically from any bank account.

Don’t dismiss cashback cards with an annual fee. While it might seem counterintuitive to pay an annual fee on a cashback card, cards with a fee generally deliver better rewards and perks. If these perks are worth more than the annual fee (and if the card fits your spending habits in other ways), it might be worthwhile for you.

Cashback vs. rewards credit cards

If you’re on the fence about what you want from your credit card, check out how cashback and rewards cards compare.

| Feature | Cashback credit card | Rewards credit card |

|---|---|---|

| Earning structure | Earn a percentage of cash back for purchases | Earn points or miles for purchases |

| Redemption options | Statement credits | Travel (like flights and hotels) Merchandise Gift cards Charitable donations Statement credits |

| Value potential | Usually fixed value | Variable depending on the redemption option |

| Potential perks | Welcome bonuses Fuel discounts No foreign exchange fees | Welcome bonuses Insurance coverage Fuel discounts Travel discounts and offers Concierge service |

| Annual fees | Often no or low annual fees | Usually higher, especially with premium rewards cards |

| Flexibility | Limited flexibility, especially if cash back is only paid out annually | Most flexibility, as you can use different redemption options every month |

| Best for | People who want simplicity and predictable value | People who frequently travel and want a variety of redemption options |

FAQs

The BMO CashBack World Elite Mastercard has the highest cash back rates by spending category, but the Rogers Red World Elite Mastercard has the best base earn rate. Ultimately, the card that gives you the most cash back is the one that matches your spending style.

Despite any drawbacks, cashback cards reward you with cash, which is flexible and easy to redeem without blackout dates, complicated charts, or other restrictions. If you’re looking for a way to put your spending to work for you, a cashback card is a strong choice.

The BMO CashBack World Elite offers 5% back on groceries with an annual rate of $120. For $125 per year, you can use the Neo World Elite Mastercard, which starts with 5% cashback on groceries and offers 7% as a boosted rate for those who bank with them.