Making smarter asset location decisions

Setting up a portfolio with proper asset allocation is easy. The hard part is maintaining the right balance when you add new money.

Advertisement

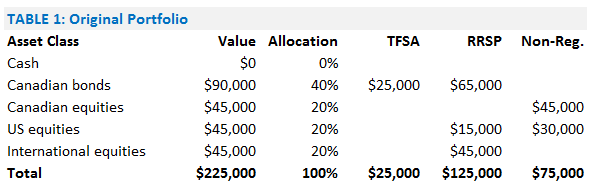

Setting up a portfolio with proper asset allocation is easy. The hard part is maintaining the right balance when you add new money.

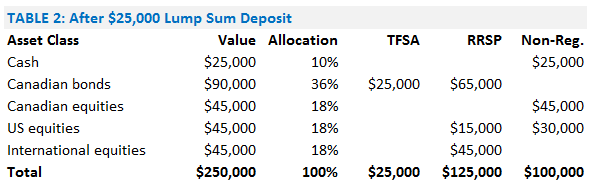

So far, so good. But now you’ve won second prize in a beauty contest and received a $25,000 windfall. Since you can’t add it to your tax-sheltered savings, you put the money in your non-registered account. Then you enter the new values into your rebalancing spreadsheet and discover your portfolio is now off its target:

So far, so good. But now you’ve won second prize in a beauty contest and received a $25,000 windfall. Since you can’t add it to your tax-sheltered savings, you put the money in your non-registered account. Then you enter the new values into your rebalancing spreadsheet and discover your portfolio is now off its target:

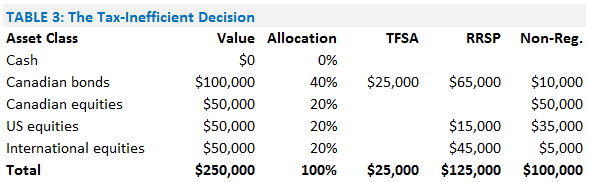

The naive way to rebalance your portfolio would be to make all the transactions in your non-registered account. You could simply use your new cash to buy $10,000 worth of bonds and $5,000 each of Canadian, US and international equities:

The naive way to rebalance your portfolio would be to make all the transactions in your non-registered account. You could simply use your new cash to buy $10,000 worth of bonds and $5,000 each of Canadian, US and international equities:

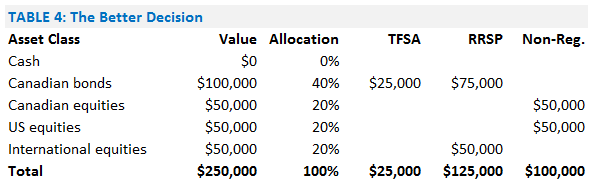

Now your portfolio is in balance, but it’s not very tax-efficient because you’re holding bonds in a taxable account. A better solution would be to use the new $25,000 to top up your non-registered holdings in Canadian equities ($5,000) and US equities ($20,000). Then in your RRSP you should sell your $15,000 of US equities and buy more bonds ($10,000) and international equities ($5,000). Now the portfolio looks like this:

Now your portfolio is in balance, but it’s not very tax-efficient because you’re holding bonds in a taxable account. A better solution would be to use the new $25,000 to top up your non-registered holdings in Canadian equities ($5,000) and US equities ($20,000). Then in your RRSP you should sell your $15,000 of US equities and buy more bonds ($10,000) and international equities ($5,000). Now the portfolio looks like this:

All the tax-inefficient bonds are now safely in your RRSP, while the US stocks are in your non-registered account, where the foreign withholding taxes on dividends are recoverable and you can benefit from tax-loss harvesting. You’ve not only made your portfolio far more tax-efficient, but also easier to manage as you’re now dealing with just five holdings instead of eight.

You don’t need to worry much about these kinds of decisions when making small monthly contributions. But any time you make a large lump sum contribution it’s worth getting out the spreadsheet and finding the most elegant and tax-efficient way to divide your assets among all your accounts.

All the tax-inefficient bonds are now safely in your RRSP, while the US stocks are in your non-registered account, where the foreign withholding taxes on dividends are recoverable and you can benefit from tax-loss harvesting. You’ve not only made your portfolio far more tax-efficient, but also easier to manage as you’re now dealing with just five holdings instead of eight.

You don’t need to worry much about these kinds of decisions when making small monthly contributions. But any time you make a large lump sum contribution it’s worth getting out the spreadsheet and finding the most elegant and tax-efficient way to divide your assets among all your accounts.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email