The right way to draw down on retirement savings

Stave off retirement ruin with some quick math

Advertisement

Stave off retirement ruin with some quick math

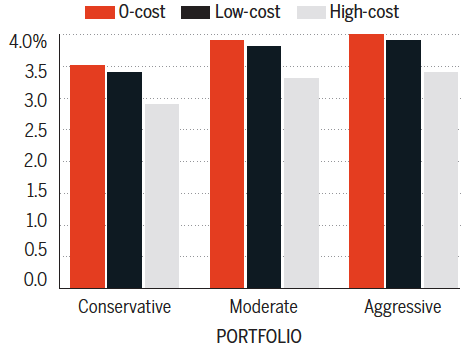

Notes: This figure models expense ratios of 0% (for 0-cost), and 0.25% (for low-cost), and 1.25% (for high-cost). This figure’s projections, generated by the Vanguard Capital Markets Model, are based in U.S. dollars as of December 31, 2011, and assume an 85% overall portfolio success rate.

Source: Vanguard

Jonathan Chevreau is Founder of the Financial Independence hub and co-author of Victory Lap Retirement. Read more of his Retired Money column here.

Notes: This figure models expense ratios of 0% (for 0-cost), and 0.25% (for low-cost), and 1.25% (for high-cost). This figure’s projections, generated by the Vanguard Capital Markets Model, are based in U.S. dollars as of December 31, 2011, and assume an 85% overall portfolio success rate.

Source: Vanguard

Jonathan Chevreau is Founder of the Financial Independence hub and co-author of Victory Lap Retirement. Read more of his Retired Money column here.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email