Couch potato on ice

This week both Canadian Capitalist and I were dismissive about the Dynamic Funds that swept this year’s Canadian Investment Awards. We argued that it’s easy to celebrate past performance, but impossible to identify managers whose success will continue in the future. One commenter on CC’s blog, a financial advisor, disagreed and suggested that choosing a [...]

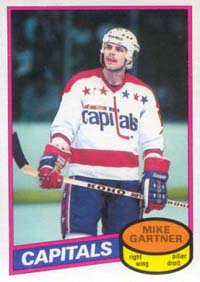

This week both Canadian Capitalist and I were dismissive about the Dynamic Funds that swept this year’s Canadian Investment Awards. We argued that it’s easy to celebrate past performance, but impossible to identify managers whose success will continue in the future. One commenter on CC’s blog, a financial advisor, disagreed and suggested that choosing a manager who will outperform is no different from identifying a skilled hockey player.

This comparison just doesn’t hold up. If a hockey player scores twice as many points as the average player for several years in a row, it is highly likely his superior performance will continue, because skill determines virtually 100% of a player’s results. Sidney Crosby can be fully expected to outscore the average NHL player for a very long time.

Investing is nothing like playing in the NHL. The bulk of an investor’s return comes from simply accepting market risk, which requires no skill whatsoever. Anyone who buys an index fund can instantly obtain near-market returns, and indeed, he or she will beat most professional managers after costs. I accept that it’s possible to identify skilled managers, but the best they can hope for is returns that are incrementally better. One can never hope to identify a money manager who will dramatically outperform his or her peers, or the market averages, with anything like the consistency of a Sidney Crosby.

This week both Canadian Capitalist and I were dismissive about the Dynamic Funds that swept this year’s Canadian Investment Awards. We argued that it’s easy to celebrate past performance, but impossible to identify managers whose success will continue in the future. One commenter on CC’s blog, a financial advisor, disagreed and suggested that choosing a manager who will outperform is no different from identifying a skilled hockey player.

This comparison just doesn’t hold up. If a hockey player scores twice as many points as the average player for several years in a row, it is highly likely his superior performance will continue, because skill determines virtually 100% of a player’s results. Sidney Crosby can be fully expected to outscore the average NHL player for a very long time.

Investing is nothing like playing in the NHL. The bulk of an investor’s return comes from simply accepting market risk, which requires no skill whatsoever. Anyone who buys an index fund can instantly obtain near-market returns, and indeed, he or she will beat most professional managers after costs. I accept that it’s possible to identify skilled managers, but the best they can hope for is returns that are incrementally better. One can never hope to identify a money manager who will dramatically outperform his or her peers, or the market averages, with anything like the consistency of a Sidney Crosby.