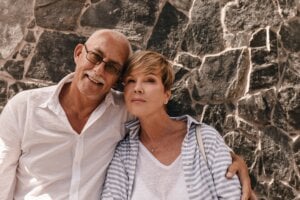

We’re 10 years apart. Can we retire together?

Retirement planning for couples with a significant age difference calls for realistic projections but also flexibility.

Advertisement

Retirement planning for couples with a significant age difference calls for realistic projections but also flexibility.

Short answer: Yes. But to take advantage of this amazing tax shelter, you need to understand the CRA’s rules...

Many investors disparage bonds—with good reason. You have to determine what problems these investments solve and whether there are...

Under what circumstances can you obtain the greatest tax savings on this $2,000 credit?

Advertisement

Different retirement income strategies using registered accounts produce different outcomes. You must pick your priorities.

If you receive a severance package, you’ll have choices to make around your finances. Here’s how to make the...

While most Canadians will benefit from continuing to contribute until the day they retire, some will be better off...

New homes generally have sales tax payable. What if you build or substantially renovate your home?

Advertisement

Ontario heirs face a huge tax bill after their parents’ deaths—highlighting the importance of planning ahead to reduce taxes...