These three people co-own a house. Who pays tax on rental income?

In real estate investing, your taxes depend on whether you're a partner or co-owner

Advertisement

In real estate investing, your taxes depend on whether you're a partner or co-owner

Preet owns a house with his brother. His situation is complicated, to say the least

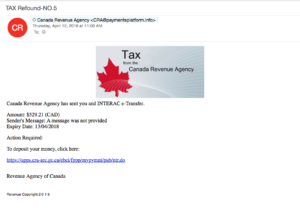

How to spot a phishing scam from the so-called taxman

Beware of new Principal Residence tax rules, and don't miss out on these new credits

Advertisement

TFSAs get good tax treatment in Ottawa, not Washington DC

When you invest together, you get taxed together

Climbing interest rates render this question more important than ever

Parents, students, commuters and others may be affected

Advertisement

Putting a child on the title of a rental house could be like playing a game of whack-a-mole