What’s happening to my bond ETF?

If your portfolio includes a broad-based bond index fund, you’ve probably noticed its value has fallen significantly over the past several weeks. Judging from recent e-mails I’ve received, the reasons for this decline are not always clear, so let’s take a closer look.

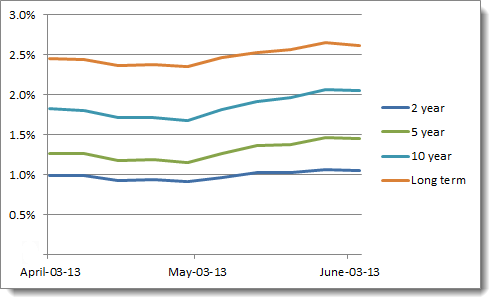

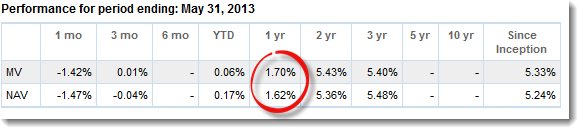

Notice that all of these rates moved upward in May, and the steepest line belongs to 10-year bonds, which have seen yields jump from 1.68% at the beginning of the month to 2.07% on May 29. As a result the iShares DEX Universe Bond (XBB), the BMO Aggregate Bond (ZAG) and the Vanguard Canadian Aggregate Bond (VAB), all which have an average term of about 10 years, saw their market prices fall significantly during the month:

Notice that all of these rates moved upward in May, and the steepest line belongs to 10-year bonds, which have seen yields jump from 1.68% at the beginning of the month to 2.07% on May 29. As a result the iShares DEX Universe Bond (XBB), the BMO Aggregate Bond (ZAG) and the Vanguard Canadian Aggregate Bond (VAB), all which have an average term of about 10 years, saw their market prices fall significantly during the month:

If yields continue to rise, bond funds can and will deliver negative returns even after accounting for interest payments, so you should be prepared for that. Remember why bonds are in your portfolio: they lower overall volatility and provide a cushion when equities inevitably suffer a downturn. If bonds do have a difficult year, that’s not a reason to abandon them: it’s an opportunity to rebalance.

If yields continue to rise, bond funds can and will deliver negative returns even after accounting for interest payments, so you should be prepared for that. Remember why bonds are in your portfolio: they lower overall volatility and provide a cushion when equities inevitably suffer a downturn. If bonds do have a difficult year, that’s not a reason to abandon them: it’s an opportunity to rebalance.