Make the most of sudden windfall

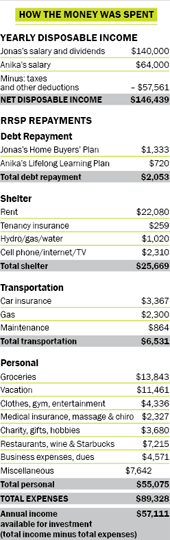

Jonas and Anika Finn are about to receive $125,000 from the sale of a business. Should they use the money to beef up their meagre retirement savings or buy a home in Vancouver’s sky-high real estate market?

Advertisement

Jonas and Anika Finn are about to receive $125,000 from the sale of a business. Should they use the money to beef up their meagre retirement savings or buy a home in Vancouver’s sky-high real estate market?

Both Jonas and Anika walked away from their previous marriages with some debt. “I used a $30,000 settlement from my divorce to pay off my college bills and credit-card debt,” Anika says. Jonas’ debt increased after leaving his initial job and striking out on his own. Despite inventing software for the agricultural industry, he closed his business when he was about $200,000 in debt. “I just finished paying off my debt four years ago,” he says.

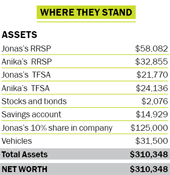

After meeting in 2008, the couple married in 2010 and spent the last three years saving and investing in earnest. Each contributes to a Tax-Free Savings Account and RRSP. While they have some of their investments in exchange-traded funds and dividend-paying stocks, most of it now sits in cash while they decide whether they should buy a home. “Unlike most other people who met in their 20s and bought houses at more reasonable prices, we have been watching the market for three years now and feel we’ll never be able to catch up,” Jonas frets. “We are concerned that with super-high prices now in Vancouver, this might be the wrong time to buy.”

The couple figures buying a modest house for $850,000 would leave them with a $535,000 mortgage. Amortized over 25 years at 4.5% this would cost them about $2,900 to carry monthly—or $34,800 annually. Property taxes and other household expenses would add $15,000 to that annual outlay. They fear they will have little left over to put towards investments. “Honestly, that scares me,” says Jonas, who values flexibility. “I don’t want to appear paranoid but I don’t feel totally comfortable with the idea of putting all our eggs into the real estate basket. Even though I know the long-held wisdom is that home ownership is a great investment, I’m not 100% sold on the idea that it’s for us—even if we do get a $100,000 gift if we buy.”

The good news is that even if Jonas sells his business, he will be able to stay on at a salary of $140,000—a salary he figures he’ll be hard-pressed to duplicate if he finds another job in the tech or financial services sector. “If I left I’d probably make only $110,000 or so,” says Jonas. “Then we’d be able to save just $40,000 annually, after taxes and expenses. I don’t know if that would be enough to give us a really comfortable retirement.”

While Anika and Jonas both plan to work until at least age 60, they’d like to spend much of their retirement pursuing travel and hobbies on a full-time basis. “We’d probably qualify for full CPP and OAS if we start collecting at age 65, but our investments would have to provide the rest,” says Anika. “Travel is expensive so we figure we’d need $65,000 net annually for at least the first 10 years to live the retirement we want. That’s a lot.”

That means most of the couple’s retirement income will have to come from their investments. “Anika has just started investing in the couch potato and I dabble in dividend-paying stocks,” Jonas says. “We’re confident investing on our own. We just need a clear long-term plan to make our retirement dream come true. We hope we haven’t started too late.”

Both Jonas and Anika walked away from their previous marriages with some debt. “I used a $30,000 settlement from my divorce to pay off my college bills and credit-card debt,” Anika says. Jonas’ debt increased after leaving his initial job and striking out on his own. Despite inventing software for the agricultural industry, he closed his business when he was about $200,000 in debt. “I just finished paying off my debt four years ago,” he says.

After meeting in 2008, the couple married in 2010 and spent the last three years saving and investing in earnest. Each contributes to a Tax-Free Savings Account and RRSP. While they have some of their investments in exchange-traded funds and dividend-paying stocks, most of it now sits in cash while they decide whether they should buy a home. “Unlike most other people who met in their 20s and bought houses at more reasonable prices, we have been watching the market for three years now and feel we’ll never be able to catch up,” Jonas frets. “We are concerned that with super-high prices now in Vancouver, this might be the wrong time to buy.”

The couple figures buying a modest house for $850,000 would leave them with a $535,000 mortgage. Amortized over 25 years at 4.5% this would cost them about $2,900 to carry monthly—or $34,800 annually. Property taxes and other household expenses would add $15,000 to that annual outlay. They fear they will have little left over to put towards investments. “Honestly, that scares me,” says Jonas, who values flexibility. “I don’t want to appear paranoid but I don’t feel totally comfortable with the idea of putting all our eggs into the real estate basket. Even though I know the long-held wisdom is that home ownership is a great investment, I’m not 100% sold on the idea that it’s for us—even if we do get a $100,000 gift if we buy.”

The good news is that even if Jonas sells his business, he will be able to stay on at a salary of $140,000—a salary he figures he’ll be hard-pressed to duplicate if he finds another job in the tech or financial services sector. “If I left I’d probably make only $110,000 or so,” says Jonas. “Then we’d be able to save just $40,000 annually, after taxes and expenses. I don’t know if that would be enough to give us a really comfortable retirement.”

While Anika and Jonas both plan to work until at least age 60, they’d like to spend much of their retirement pursuing travel and hobbies on a full-time basis. “We’d probably qualify for full CPP and OAS if we start collecting at age 65, but our investments would have to provide the rest,” says Anika. “Travel is expensive so we figure we’d need $65,000 net annually for at least the first 10 years to live the retirement we want. That’s a lot.”

That means most of the couple’s retirement income will have to come from their investments. “Anika has just started investing in the couch potato and I dabble in dividend-paying stocks,” Jonas says. “We’re confident investing on our own. We just need a clear long-term plan to make our retirement dream come true. We hope we haven’t started too late.”

Annie Kvick, a money coach with Money Coaches Canada in North Vancouver, agrees. “Renting versus owning is one of the most often-asked questions in financial planning,” says Kvick. “There is no one right answer. The Finns need to pick the path that will give them the flexibility and long-term financial well-being they crave.” Here are the pros and cons of both options.

Scenario 1: Buying a home. Home ownership is not “a slam-dunk,” says Franklin. “In fact, from 1990 to 2000, housing was a bad investment, returning 0% throughout the decade. The Finns need to be aware of that.” And the truth is $850,000 won’t get the Finns much of a house in Vancouver’s pricey market. “They have to go to $950,000 to get a place their in-laws will be happy to live in,” says Franklin. “That means a mortgage closer to $635,000. That’s huge.”

Even so, Kvick believes the couple would do fine financially if they bought a house—provided house prices keep rising at an annual rate of 4% and mortgage rates stay under 6%. “What this scenario has going for it is the $100,000 gift from Anika’s parents, reliable tenants in the basement and tax-free capital gains on a principal residence when they sell,” says Kvick. “Those are huge pluses.”

Even if rates go up, Kvick feels the couple has enough in excess spending (Starbucks, restaurants, travel, etc.) that they can cut back prudently for a few years. For instance, on a $635,000 mortgage at 4.5% amortized over 25 years and paid biweekly, the Finns would have total annual mortgage payments of about $42,000. Rental income from the basement would cover $18,000, leaving the couple with $24,000 to pay annually on their own. At present they pay $22,000 a year in rent. “With property taxes and other expenses, it will cost them only about $15,000 more each year to own rather than rent,” says Kvick. “That will give the Finns a paid-off home in 25 years.”

The couple could then invest their remaining disposable income—about $40,000 annually if Jonas stays at his present job and salary. “They can expect an annual return of about 5% with a portfolio split of 60% equities and 40% fixed-income investments,” Kvick says. “Then they can retire at age 65 with $1.5 million, as well as have a paid-off house.” If Jonas leaves his job and earns less, and they only invested $20,000 annually in RRSPs and TFSAs, that would still allow them to retire at 65 with a more modest $800,000 investment portfolio and a home owned free and clear. They’d also have $18,000 a year in rental payments from their basement apartment. The catch? They have to be happy living with their in-laws for several years. “If they don’t mind that, this option will work beautifully,” Kvick says.

Scenario 2: Lifelong flexibility through investing. The second scenario offers the Finns maximum flexibility and a comfortable retirement when Jonas is 60 and Anika is 58. Franklin believes the best option for their lifestyle is to invest the $57,000 they have in excess income in low-fee exchange-traded funds, dividend-paying stocks and a few growth stocks, and forget about home ownership. “They spend so much at Starbucks and Whole Foods that they would do well to add some of these stocks to their portfolio,” Franklin says.

Given their ages, Franklin figures the Finns can split their equity portfolio into 60% blue-chip, dividend-paying stocks, 10% growth stocks (but not technology) and 30% fixed income. “They should max out their RRSPs and TFSAs with ETFs and stocks. Any leftover savings should be put into a non-registered investment account.”

If they do this they will have close to $2 million in investments by the time Jonas reaches age 60—or about $1.5 million if he accepts a lower-paying job and the couple is able to invest only $37,000 a year (net after taxes and other expenses). “With close to full CPP and OAS at age 65, the couple will have enough money to easily give them the $65,000 net annually that they crave, in order to travel and lead an adventure-filled life—even if they retire at 60 or so.” For Franklin, this option is closer to the spirit of what the Finns really desire. Now it’s up to the Finns to make the final choice.

Would you like MoneySense to consider your financial situation in a future Family Profile? Drop us a line at [email protected]. If we use your story, your name will be changed to protect your privacy.

Julie Cazzin is an award-winning business journalist and personal finance writer based in Toronto. Read previous Family Profiles by Julie.

Annie Kvick, a money coach with Money Coaches Canada in North Vancouver, agrees. “Renting versus owning is one of the most often-asked questions in financial planning,” says Kvick. “There is no one right answer. The Finns need to pick the path that will give them the flexibility and long-term financial well-being they crave.” Here are the pros and cons of both options.

Scenario 1: Buying a home. Home ownership is not “a slam-dunk,” says Franklin. “In fact, from 1990 to 2000, housing was a bad investment, returning 0% throughout the decade. The Finns need to be aware of that.” And the truth is $850,000 won’t get the Finns much of a house in Vancouver’s pricey market. “They have to go to $950,000 to get a place their in-laws will be happy to live in,” says Franklin. “That means a mortgage closer to $635,000. That’s huge.”

Even so, Kvick believes the couple would do fine financially if they bought a house—provided house prices keep rising at an annual rate of 4% and mortgage rates stay under 6%. “What this scenario has going for it is the $100,000 gift from Anika’s parents, reliable tenants in the basement and tax-free capital gains on a principal residence when they sell,” says Kvick. “Those are huge pluses.”

Even if rates go up, Kvick feels the couple has enough in excess spending (Starbucks, restaurants, travel, etc.) that they can cut back prudently for a few years. For instance, on a $635,000 mortgage at 4.5% amortized over 25 years and paid biweekly, the Finns would have total annual mortgage payments of about $42,000. Rental income from the basement would cover $18,000, leaving the couple with $24,000 to pay annually on their own. At present they pay $22,000 a year in rent. “With property taxes and other expenses, it will cost them only about $15,000 more each year to own rather than rent,” says Kvick. “That will give the Finns a paid-off home in 25 years.”

The couple could then invest their remaining disposable income—about $40,000 annually if Jonas stays at his present job and salary. “They can expect an annual return of about 5% with a portfolio split of 60% equities and 40% fixed-income investments,” Kvick says. “Then they can retire at age 65 with $1.5 million, as well as have a paid-off house.” If Jonas leaves his job and earns less, and they only invested $20,000 annually in RRSPs and TFSAs, that would still allow them to retire at 65 with a more modest $800,000 investment portfolio and a home owned free and clear. They’d also have $18,000 a year in rental payments from their basement apartment. The catch? They have to be happy living with their in-laws for several years. “If they don’t mind that, this option will work beautifully,” Kvick says.

Scenario 2: Lifelong flexibility through investing. The second scenario offers the Finns maximum flexibility and a comfortable retirement when Jonas is 60 and Anika is 58. Franklin believes the best option for their lifestyle is to invest the $57,000 they have in excess income in low-fee exchange-traded funds, dividend-paying stocks and a few growth stocks, and forget about home ownership. “They spend so much at Starbucks and Whole Foods that they would do well to add some of these stocks to their portfolio,” Franklin says.

Given their ages, Franklin figures the Finns can split their equity portfolio into 60% blue-chip, dividend-paying stocks, 10% growth stocks (but not technology) and 30% fixed income. “They should max out their RRSPs and TFSAs with ETFs and stocks. Any leftover savings should be put into a non-registered investment account.”

If they do this they will have close to $2 million in investments by the time Jonas reaches age 60—or about $1.5 million if he accepts a lower-paying job and the couple is able to invest only $37,000 a year (net after taxes and other expenses). “With close to full CPP and OAS at age 65, the couple will have enough money to easily give them the $65,000 net annually that they crave, in order to travel and lead an adventure-filled life—even if they retire at 60 or so.” For Franklin, this option is closer to the spirit of what the Finns really desire. Now it’s up to the Finns to make the final choice.

Would you like MoneySense to consider your financial situation in a future Family Profile? Drop us a line at [email protected]. If we use your story, your name will be changed to protect your privacy.

Julie Cazzin is an award-winning business journalist and personal finance writer based in Toronto. Read previous Family Profiles by Julie.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email