The true price of financial advice

Transparency shines a light on the value of paying for help when investing

Advertisement

Transparency shines a light on the value of paying for help when investing

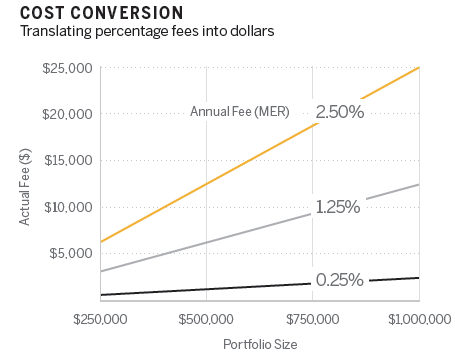

To put that in perspective, the minimum wage in Ontario will climb to $11.40 per hour this year. Sturdy retirees who are willing to work 40 hours a week for 52 weeks a year for minimum wage will make $23,713 before taxes. Alternatively, if they can slash their investment-related expenses, they might be able to save more than they’d earn, after tax.

The good news is there are several ways to cut fees, some without cutting out an advisor. Broadly speaking there are three ways to do it. You can keep the individualized advice but move to a portfolio of low-fee funds. Or you can opt to do your own planning and choose a low-fee portfolio of professionally managed funds. Finally, those with sufficient knowledge and experience can do it on their own and cut costs to the bone.

To put that in perspective, the minimum wage in Ontario will climb to $11.40 per hour this year. Sturdy retirees who are willing to work 40 hours a week for 52 weeks a year for minimum wage will make $23,713 before taxes. Alternatively, if they can slash their investment-related expenses, they might be able to save more than they’d earn, after tax.

The good news is there are several ways to cut fees, some without cutting out an advisor. Broadly speaking there are three ways to do it. You can keep the individualized advice but move to a portfolio of low-fee funds. Or you can opt to do your own planning and choose a low-fee portfolio of professionally managed funds. Finally, those with sufficient knowledge and experience can do it on their own and cut costs to the bone.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email