“Our parents just passed. What do we do about their estate?”

Two siblings’ complex inheritance provides a case study in minimizing death taxes.

Two siblings’ complex inheritance provides a case study in minimizing death taxes.

Be prepared for the financial burdens of caring for aging parents by learning about the innovative strategies that could...

When you die, capital gains tax might apply to some of your assets. Can life insurance help shelter your...

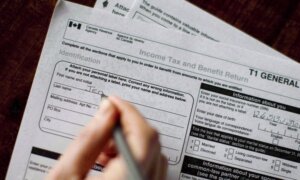

Do Canadians have to file a trust tax return this year? What is a bare trust? What are the...

Advertisement

You don’t want to miss the conversion deadline at the end of the year you turn 71—you’ll be on...

Let’s review the big changes to be aware of this tax filing season.

Most registered retirement savings plans are eventually converted to registered retirement income funds. Here’s what to know about RRIF...

Advertisement

The risk of having too much money left when you die is real. Often realizing this comes too late...