Making sense of the markets this week: February 4, 2024

Facebook reports a massive earnings day, the stocks with solid quarters, the U.S. Fed stands pat and why Canadian investors keep a long-term outlook.

Advertisement

Facebook reports a massive earnings day, the stocks with solid quarters, the U.S. Fed stands pat and why Canadian investors keep a long-term outlook.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

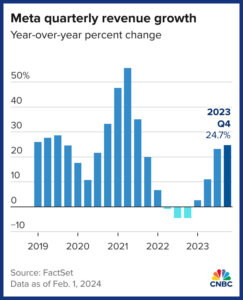

While all four of the tech titans that announced quarterly earnings this week managed to beat their predicted earnings and revenue targets, only Facebook announced earnings that really got investors excited.

All numbers below are in U.S. currency.

With Meta, often referred to as Facebook, announcing excellent ad revenue growth, decreased expenses, and even introducing its first-ever dividend ($0.50 a share, paid in March), it was no surprise to see share prices pop in after-hours trading on Thursday. That said, the 14% surge (on top of a 12% year-to-date gain) caps off an incredible run for Facebook that has seen the share price quadruple since November 2022. This good news comes despite the virtual reality unit at Facebook losing $4.65 billion this quarter (which is about what the entire company of Air Canada is worth as a comparison).

When Microsoft and Alphabet released earnings on Tuesday, it was puzzling to see the solid earnings results lead to substantial drops in share prices for both companies. This price movement was likely due to sky-high expectations that led to outsized price run-ups in 2023 and the first month of 2024.

Considering that bigger picture is important, as Microsoft is still up over 7% year to date, and Google (despite an 8% loss on Wednesday) is up nearly 2% so far in 2024.

Both Google and Microsoft announced that their cloud computing services were large growth vectors, and that layoffs were in the works in the name of cost-cutting and efficiency.

Apple had similar earnings results to Google and Microsoft, as they beat their earnings projections but share prices were down 4% in after hours trading on Thursday, as several red flags were apparent in their quarterly earnings numbers. Most notably, a 13% sales decrease in China, and decreased revenue guidance for iPhones going forward. The stock is basically flat year-to-date.

On our side of the border this week, the notable earnings calls included Brookfield Infrastructure and CP Rail.

All figures in Canadian dollars, unless otherwise stated.

Before you get too worried about those wonky results from Brookfield, keep in mind that their reported numbers are often quite complicated to make sense out of due to their unique corporate structure and accounting practices. Given that the massive infrastructure conglomerate is often buying and selling large utilities, its quarterly numbers can look misleading. In this instance, the market took the news in stride, as BIP was up over 1% on the day.

Brookfield Infrastructure’s CEO Sam Pollock said, “We successfully executed our business strategy and achieved all our capital allocation and performance targets during 2023. We believe 2024 will be an even better year, and we are already off to a strong start on our capital recycling and deployment initiatives.”

Companies that are similar to BIP (such as utility companies) often use the metric of “Free Funds from Operations (FFO) as their preferred comparison measurement. FFO for Brookfield for 2023 was up 10% on 2022, and they increased their dividend by 6%—thus signalling confidence in future cash flows.

Echoing much of the hopeful economic news of competitor Canadian National Railway (CNR) last week, CP believes that a rising economic tide will lift their, er, railcars.

CP highlighted that it managed to increase its operating ratio from 62.2% to 65% in 2023, resulting in a more profitable bottom line.

CP president and chief executive officer Keith Creel stated:

“I am proud of how our team of incredible railroaders finished this transformational year with a strong fourth quarter, allowing CPKC to deliver volume growth and best-in-class earnings growth in 2023. Looking forward to 2024, we are confident that our unique synergy opportunities, along with improving macroeconomic conditions, can overcome a weak Canadian grain crop and position us for another strong performance this year, our first full year as a combined company.”

The “combined company” Creel refers to is the addition of the Kansas City Southern network of railways, which we wrote about in mid-2023. The true value of the new company will largely depend on how well CP can integrate these new assets, and use them to maximize the value of the expanded network.

Read more on MoneySense’s ranking of Canada’s best dividend stocks from MoneySense, and blue-chip Canadian companies at MillionDollarJourney.ca.

Get up to 3.50% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.65%.

Earn 4.25% for 4 months on eligible deposits up to $100k. Offer ends September 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

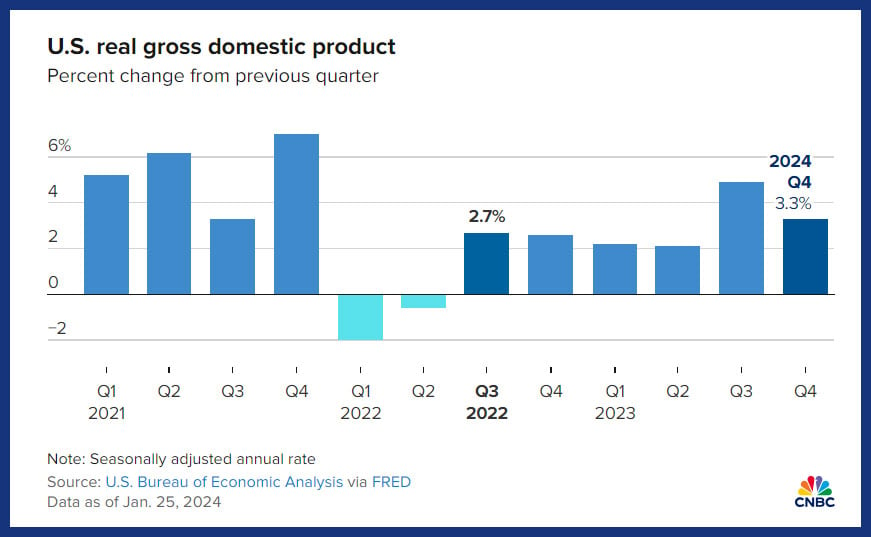

The market responded with a sharp push downward on Wednesday after the U.S. Federal Reserve decided to, not only hold rates steady, but also soften language further around the timing of future cuts.

Here are a few takeaways from the U.S. Fed Chairman Powell’s statement, and analysis of the decision:

Meanwhile, here in Canada, our fears of an immediate recession receded as official gross domestic product (GDP) measurements revealed an increase of 0.2% in November, and 0.3% in December. It should be noted that per-capita GDP continues to trend downward for the sixth consecutive fiscal quarter.

For survey and data buffs looking for insights on Canadian temperament, know that Questrade recently released the results of its Investment Sentiment Survey. It was completed by Leger last November. (Questrade is a Canadian online broker. Read our Questrade review.)

The headline findings were:

However, it was the data around financial literacy that most caught my eye.

It’s long been my personal suspicion that Canadians vastly overrate their financial knowledge on surveys. It’s sort of like how 93% of us will answer that we are better-than-average drivers. Not only is it mathematically impossible that 93% of people can be better-than-average, it only takes a few morning commute drives to find out that there are way more than 7% of drivers out there who are pretty awful!

The issue is that we don’t know what we don’t know. In other words, if you’re financially illiterate, you may not be able to accurately measure your own knowledge of financial literacy.

Questrade’s survey also revealed that 60% of Canadians both consider themselves financially literate and rely on their financial services provider to supply the financial education resources they need. Furthermore, 42% of younger Canadians (aged 18 to 34) intend to try emerging technologies to help inform their investment decisions.

Does that include TikTok? Surely it must include AI (artificial intelligence). Regardless, I see AI as only helping with broad research. And while there’s a ton of info on every social media platform, the quality ultimately has to be determined by the follower, according to researchers.

For younger Canadians placing the fate of their investments in “emerging technologies” for informed decisions, I think that speaks to misplaced faith. Anyone who relies on people that make money from their investment decisions to provide financial literacy advice to them cannot by definition be considered financially literate. There is nothing “emergent” about the fundamental principles of investing.

Key concepts such as earnings growth, transparent markets providing efficient pricing mechanisms, and cutting investing fees to the bone are several decades old. But they continue to be just as true today as they were when folks like John Bogle (founder of Vanguard) initiated with them. Relying on AI, or some other definition of emerging technologies, to inform investment decisions is just noise drowning out simple investment truths that every generation struggles to learn anew. If it’s not broke, AI and TikTok certainly don’t need to fix it.

While I recommend taking self-reported survey results with a grain of salt, it’s cool to see that most Canadian investors have a long-term outlook in regards to their portfolios. The prioritizing of retirement savings is also great to see. Now we all just need to make sure that we’re not overcomplicating this whole investing thing by getting our information from questionable sources.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email