Making sense of the markets this week: June 2, 2024

Canadian banks prep for the worst, HP and Best Buy up big, more profits means higher-priced shares, and whatever happened to stagflation?

Advertisement

Canadian banks prep for the worst, HP and Best Buy up big, more profits means higher-priced shares, and whatever happened to stagflation?

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Canadian banks continue to prepare for worst-case scenarios with increased credit loss provisions.

Here’s how Canadian banks performed in the three months ending April 30, 2024:

All these banks in Canada commented on increased provisions for credit losses (the amount of money banks hold back in case some of their loans are defaulted on), stating it weighed on bottom lines. This is to be expected to a large degree, as it’s the price Canadian bank shareholders pay for the trustworthy reputation our banks enjoy.

BMO had the worst earnings report of the bunch, and its shares are down nearly 8% over the last five business days. Scotiabank also had some downbeat news. It was down 2% over the last week. RBC continues to prove its best-in-class credentials, with its share price up about 3%, while National Bank and CIBC posted solid results, boosting share prices by about 2%.

BMO, National Bank and RBC all increased quarterly dividends by 2.5% to 4%. This signals that these Canadian banks remain confident in future cash flows despite the uptick in loan defaults due to higher interest rates.

While TD handily beat earnings expectations, its stock price remains stuck in reverse. It’s down more than 12% year to date. The ongoing U.S.-based money-laundering investigation has the potential to cripple growth in the short term.

While TD has set aside USD$450 million to pay the probable fines, some analysts believe the penalties will be substantially more than USD$1 billion. Furthermore, TD had to invest USD$500 million into an anti-money laundering program, and some believe this will significantly impact the bank’s ability to continue its expansion plans in the USA. That’s billions of dollars that could come out of TD’s bottom line over the next couple of years.

TD CEO Bharat Masrani stated, “We know investors and other stakeholders are eager for more information on the aggregate costs and timelines and want a fuller view of the monetary and non-monetary penalties.” He added that TD is “working hard to bring these investigations to a resolution as soon as possible so that our investors can have more clarity.”

TD’s spot near the top of the Canadian bank pecking order will continue to ensure a profitable long-term outlook. At the same time, it’s difficult to properly value the company with this sort of potential loss hanging over its head. Debt rating agency Fitch downgraded TD’s outlook from stable to negative this week, causing investors even more anxiety.

For more, read about RBC’s earnings, Scotiabank’s earnings, if TD is a good stock and why TD’s profit is down. Also, see my post on the best Canadian bank stocks in 2024 on MillionDollarJourney.com.

Get up to 3.00% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.40%.

Earn 4.50% for 5 months on eligible deposits up to $500k. Offer ends January 31, 2026

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

It was a confusing week of earnings announcements in the U.S. retail and info tech sectors.

While all four companies appeared to post results largely in line with predicted earnings, the stock market’s response to each company’s earnings announcement was quite unique. HP and Best Buy were up more than 15% and 13% respectively on Tuesday, while Dell was down 5%. Costco, despite a very solid earnings report, was treading water in after-hours trading after announcing earnings late on Thursday.

There didn’t seem to be an obvious through line between the four companies’ results. HP largely credited its increased AI presence as reason to be optimistic. Best Buy on the other hand emphasized cost cuts as its main focus in the quest for thicker profit margins.

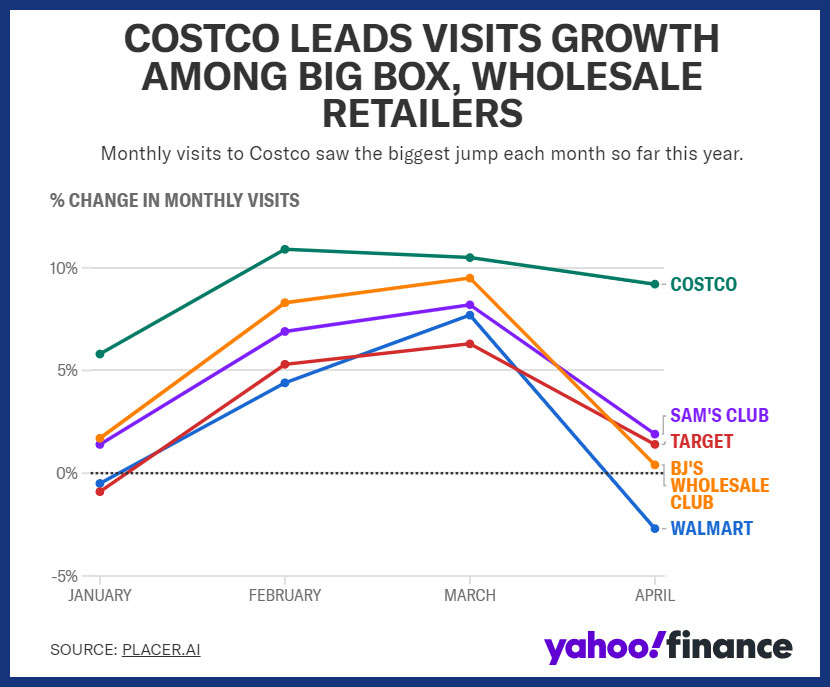

Despite the lukewarm reaction from the market, Costco’s long-term future looks the brightest to our eyes. Same-store sales were up 6.5% year over year, and it is enjoying a very impressive trend line in regards to visitor growth over the last few months.

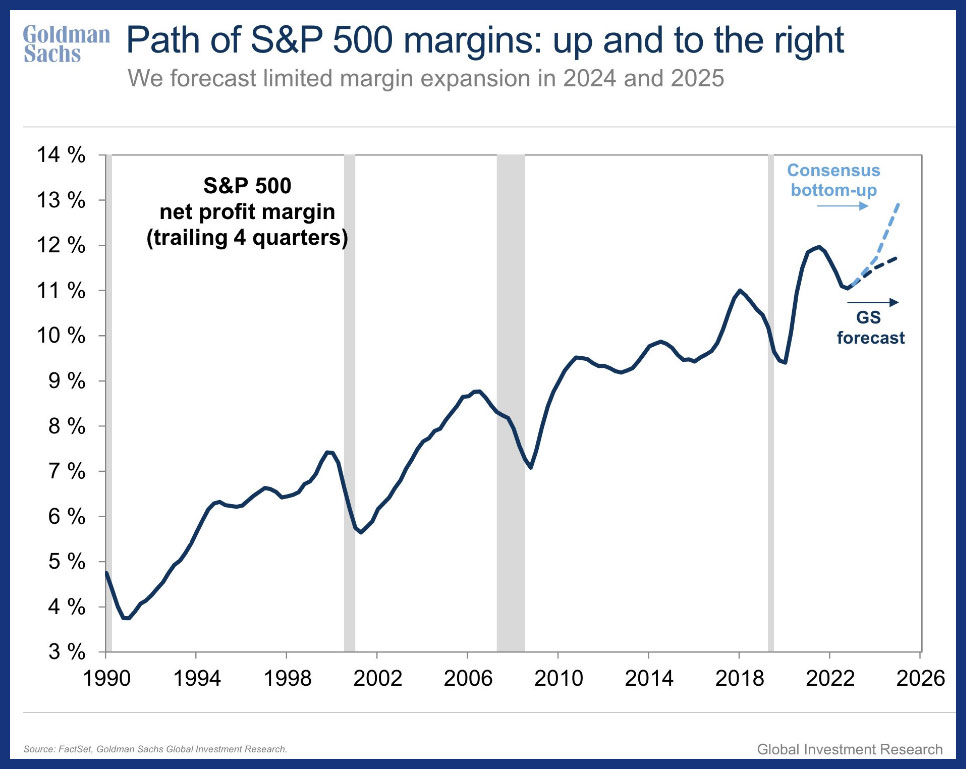

Technical analysis gurus earn their paycheques by selling theories about stock prices being the end result of psychological trends. However, sometimes it’s as simple as: A company that makes more profits is worth more money. It’s no accident that American companies grow their annual earnings about 66% of the time, while the stock market is up about 75% of the time. There is an obvious correlation happening there.

With 95% of the S&P 500 companies having reported earnings results for the first quarter, about 80% have exceeded earnings expectations. Analysts expect 11% earnings growth this year (after only 1% last year). Consequently, it makes sense that more investors are willing to pay higher prices for those future revenue streams.

What’s powering the earnings increase?

Corporations, it seems, are just really, really good at making larger-than-ever profits. There are many reasons for fatter margins. It could be innovative new products and services, lower taxation, decreasing competition, willingness of consumers to pay higher prices, and so on. The bottom line is that the stock market will certainly pull back at some point (as it did this week). And there are solid reasons why companies are worth more now than they were, say, a few years ago.

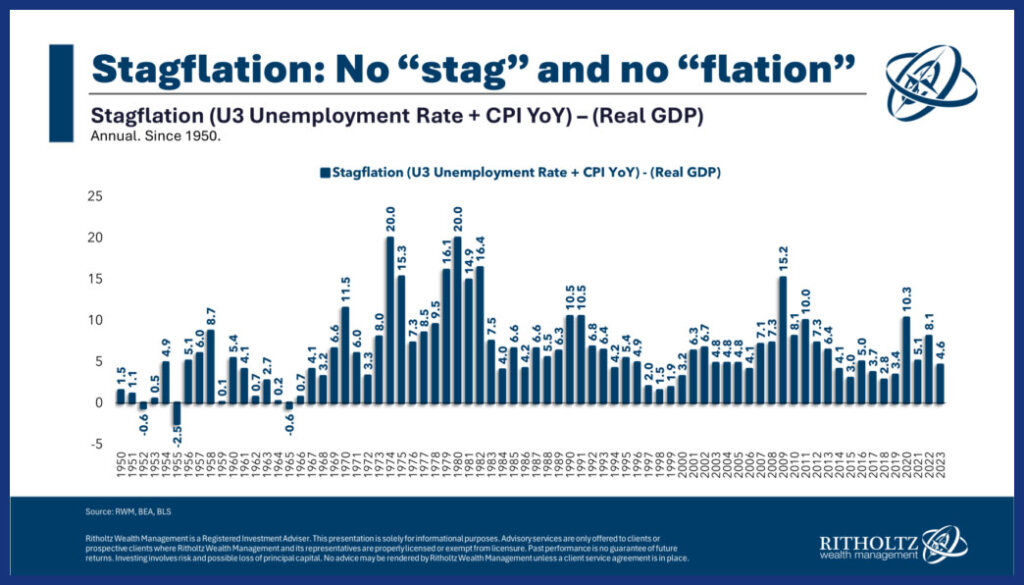

Back in spring/summer of 2022, all the “cool” writers were predicting a scary-sounding future of stagflation. We, on the other hand, were a bit more skeptical. We felt that these worst-case economic scenarios were just around the corner.

So, two years later, are we fearing that unemployment rates may shoot through the roof? Are we fearing a shrinking GDP? (Gross domestic product, that is.)

Barry Ritholtz doesn’t think so. He’s the co-founder, chairman and chief investment officer of Ritholtz Wealth Management LLC, in New York City.

The above chart illustrates what economists call the “misery index.” It’s a rough approximation of measuring stagflation.

You’ll notice that while things weren’t exactly great in 2020 and 2022, they weren’t historically bad either. Last year was downright tame, and (spoiler alert!) we’re probably in for another not-so-miserable year for 2024.

Note, though, that this features American data. While Canada’s misery index isn’t quite as upbeat as the USA’s, Canada still sits below long-term averages.

Sure, the cost of living is up in for Canadians and Americans. But so are wages. And unemployment in the USA is at 60-year lows. While growth in Canada has been “anemic,” we haven’t experienced the deep recession folks were worried about over the last couple of years. Growth in the U.S. has been excellent. And inflation has steadily trended downward in both countries.

Stagflation had a crazy run in the ’70s and into the early ’80s. Aside from brief spikes during the Great Financial Crisis in 2009 and the start of the COVID-19 pandemic, we haven’t come close to being as “economically miserable” as we were back then.

As always, remember that the sensationalistic negative headlines generate the clicks. As we’ve written before, being negative suggests you sound smarter, but when it comes to the long-term markets, defaulting to positivity means you will be right far more often than you’ll be wrong.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

You’re basically saying “the inflation you see and experience with your own eyes is an illusion”. Tired of the gaslighting by politicians and economists. What do things look like when you actually look at the things people NEED – food, energy, housing, clothing, insurance and utility costs? How much are wages up in the public vs private sector? There’s a lot of smoke and mirrors going on with all of this data, and someone at a wealth management firm is the last person a regular person should look to to tell them how great they have it.