Making sense of the markets this week: September 29, 2024

Chinese stimulus a major boost, Costco thrives and Micron shines, good times are here for investors, and are Canadian telcos in trouble?

Advertisement

Chinese stimulus a major boost, Costco thrives and Micron shines, good times are here for investors, and are Canadian telcos in trouble?

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

Many people like to sort countries’ economies as either communist, socialist, capitalist or free markets. But these days, every country has some version of a mixed economy. The practical implementation of fiscal and monetary policy is becoming increasingly more grey than our old black-and-white economics textbooks would have us believe. Yet, even within the grey, China’s approach for its economic system is uniquely difficult to define.

Back in 1962, when asked about building a socialist market economy, future China leader Deng Xiaoping famously said, “It doesn’t matter whether the cat is black or white, so long as it catches mice.”

Well, the current China leaders have let the fiscal and monetary cats out of the bag, and they’re hoping those cats are hungry.

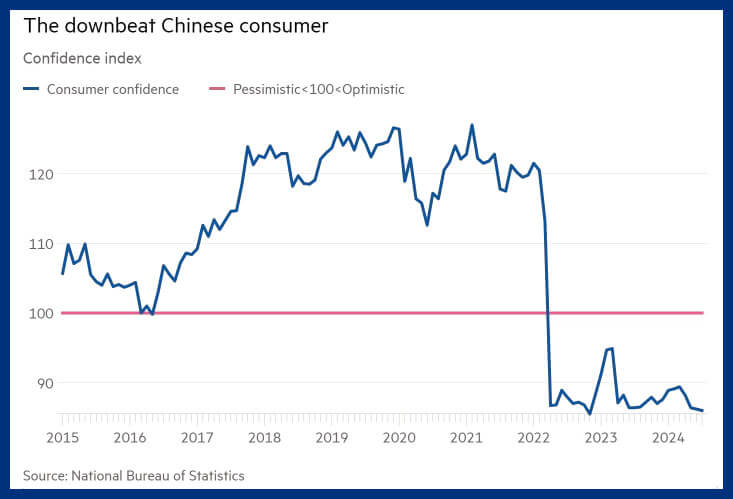

We wrote about China’s housing problems about a year ago, warning about rising deflation fears. These issues seem to have gotten worse, and the biggest news in world markets this week was that China’s government decided enough was enough. And in a “command” economy (which is probably the most accurate way to describe its approach), the government has a very high degree of control over economic levers. Consequently, markets reacted swiftly and positively to this news.

Here are the highlights of the multi-pronged fiscal and monetary stimulus that the Chinese government has decided to implement:

That last point is pretty interesting to me. Here you have a supposedly communist government essentially creating a big pot of money to spend within a free stock market. The fund is to directly purchase stocks, as well as providing cash to Chinese companies to execute stock buybacks. Good luck defining that action in traditional economic terms.

The idea is to give investors and consumers faith that they should go out there and buy or invest in China’s expanding economy. Clearly something major had to be done to jolt Chinese consumers out of their malaise.

Early reports are speculating that the Chinese gross domestic product (GDP) could fail to rise by less than the 5% target set by the government. If so, we’re about to see what happens when the commander(s) behind a command economy decide that the GDP will rise no matter what.

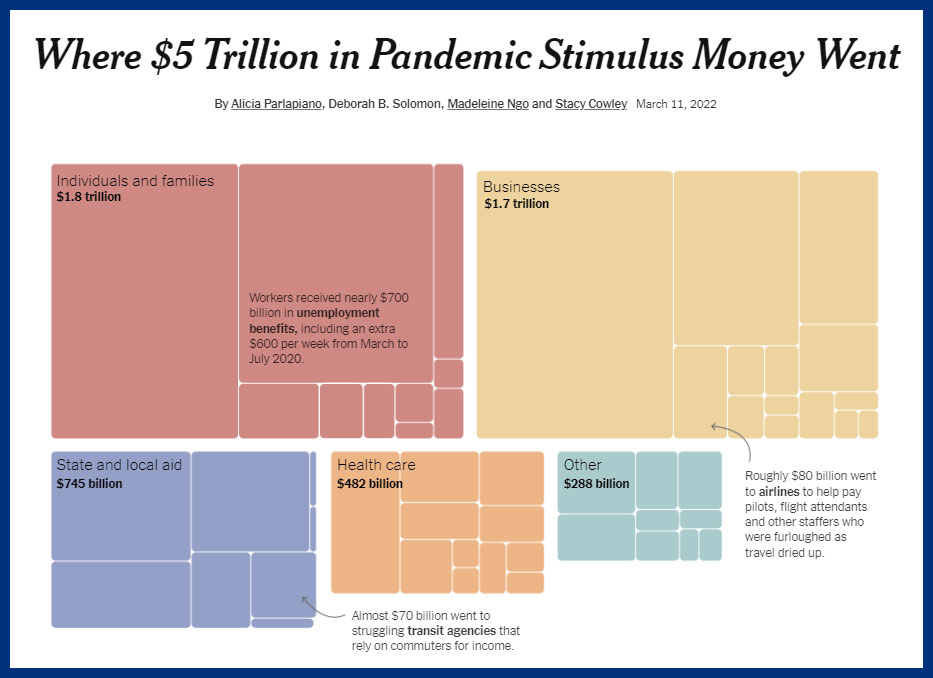

Investors responded positively to the announcements. The CSI 300 index was up 4.3% on Tuesday. However, some analysts were skeptical the scale remains far too small. Consider the U.S. government spent USD$5 trillion to keep its economy afloat during COVID-19. Then you get an idea of the scale required to really give the economic boost China needs to get going in the right direction.

It doesn’t take a genius to figure out that the local economy is going to be in some trouble when housing is responsible for 30% of GDP, and 70% of household wealth—and then the population shrinks. The question is: Can the government command its economic cats to adapt fast enough to catch new types of mice?

Check out this report on economic predictions in Canada for 2025.

Get up to 3.50% interest on your savings without any fees.

Lock in your deposit and earn a guaranteed interest rate of 3.65%.

Earn 4.25% for 4 months on eligible deposits up to $100k. Offer ends September 30, 2025.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

While Costco had a solid earnings report, chip-maker Micron stole the show in a relatively slow week for U.S. earnings.

Figures are in U.S. currency.

Tech investors appeared to be in a jubilant mood on Thursday, as a small earnings beat for Micron resulted in a massive 15% boost for its share price. Not only did Micron shares go up, other semiconductor stocks around the world increased as well on the back of strong demand data. Micron was the first chipmaker to report earnings for the quarter.

There appears to be a never-ending appetite for data centre chips of all kinds at the moment, and all companies are participating in the quickly-growing market no matter what their respective market share. A large portion of Micron’s revenues come from its partnership with AI-darling Nvidia. Micron CEO Sanjay Mehrotra stated, “With the advent of AI, we are in the most exciting period that I have seen for memory and storage in my career.”

On the other hand, Costco saw net sales rise 5.05% year over year. New products under the in-house Kirkland brand were a highlight for the retail giant. The average age of new memberships continues to trend downward for Costco, with half of all new membership sign-ups in 2024 coming from shoppers under 40. Shareholders appeared to take the news largely in stride, as share prices were down slightly in after-hours trading on Thursday. Costco shares have been on a tear so far this year, and are up about 63% over the last 12 months.

Another computer chip development to keep an eye on is the potential Qualcomm takeover of Intel. Qualcomm announced this week that it had approached the American chip maker about a potential deal. That said, many analysts are skeptical that a deal will get done due to the hurdle of needing regulatory approval from both China and the U.S.A.

Year in and year out, we can always depend on Canadian telecommunication companies to make money. The three-headed monster (Bell, Rogers and Telus) has proven it could consistently raise prices and book profits—no one bats an eye.

Slowly but surely, that’s been changing though. In a banner year for the rest of the investing world (see below), Bell and Rogers shares are down more than 12% this year, and Telus is down 6%. Valuations have gotten so beat up we’re seeing dividend yields in the 7% to 9% range.

So, why are these formerly superhuman stocks suddenly looking so mortal?

The chief reasons earnings have stagnated amongst the big three telecoms are:

Reduced interest rates will obviously help their bottom lines. The capital spending required to set up 5G networks is now scheduled to wind down. These are reasons to believe these Canadian blue-chip stocks should bounce back. That said, the current payout ratio for each of these three companies is more than 100%. Those expense lines better get cut fast as current dividend payouts aren’t sustainable over the long term.

While shareholders haven’t had much to celebrate in several years, things may be looking up. The S&P/TSX Composite Communication Services Index is up nearly 8% over the last three months. Given the long-term success of these companies and their guaranteed future dominance of the Canadian market, they’ve probably earned the benefit of the doubt.

For more information, you can check out MoneySense’s list of top 100 dividend stocks and my article on Canadian telco stocks on MillionDollarJourney.com.

Rarely in our investing lives will things ever be as good as they are right now.

A recap of the year to date so far:

Also, when the worst economic news is that Canadian housing prices are basically the same as they were a year ago, you know Canadian investors are doing pretty well since essentially every major asset class is going up at the same time.

It’s important to take note of the good times. When the bad days (inevitably) arrive, it can feel like the proverbial sky is falling and that the drops will never end. Remember that stock markets—“the world’s biggest companies”—generally experience more good years than bad ones.

We’ve mentioned the CBOE Volatility Index ETF—better known as The VIX—in this column before. It’s a good proxy for how nervous investors are feeling about the market at any given time. (Check out MoneySense’s ETF screener for more info on this ETF.)

As you can see in the chart above, we’re currently in a pretty calm period. Other than the very brief spike a few months ago from the effects of the Japan carry-trade, life is good. Enjoy it while it lasts, and don’t listen to those who say they know how and/or when it will end.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email