Making sense of the markets this week: September 8, 2024

Canada cuts rates again. Can Couche-Tard take over the convenience-store world? Mag 7 outperformance trend may be done. Dollarama crushes U.S. competitors.

Advertisement

Canada cuts rates again. Can Couche-Tard take over the convenience-store world? Mag 7 outperformance trend may be done. Dollarama crushes U.S. competitors.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

For the third straight month, the Bank of Canada (BoC) decided to cut interest rates. The quarter-point cut takes the Bank’s key interest rate down to 4.25%.

The news that’s perhaps bigger than the widely anticipated rate cut was how aggressive BoC governor Tiff Macklem sounded in his prepared remarks. Macklem stated, “If we need to take a bigger step, we’re prepared to take a bigger step.” That sentence will be focused on by financial markets looking to price in larger potential cuts in the months to come. As of Thursday, financial markets were predicting a 93% probability that October would see another 0.25% rate cut. Several economists believe interest rates would fall to around 3% by next summer.

While describing a potential soft landing to the bumpy pandemic-fuelled inflation flight we’ve been on, Macklem stated, “The runway’s in sight, but we have not landed it yet.” It appears that the real debate is no longer if the BoC should cut interest rates, but instead, how quickly it should cut them, and whether a 0.50% cut may be in the cards sooner rather than later.

With unemployment rates increasing, it follows that the inflation rate of labour-intensive services should continue to fall. Lower variable-rate mortgage interest payments will automatically have a deflationary impact on shelter costs across Canada as well.

You can read our article about the best low-risk investments in Canada at Milliondollarjourney.com if lowered interest rates have you thinking about adjusting your portfolio.

Last week we wrote about the Alimentation Couche-Tard (ATD/TSX) proposed buyout of 7-Eleven parent company Seven & i Holdings Co. If the buyout goes through, ATD would go from being Canada’s 14th-largest company to being in the running for third-largest company. That’s a big if: on Friday morning, just hours before we went to press, Seven & i said it is rejecting ATD’s $38.5-billion cash bid on the grounds it was not in the best interests of shareholders and was likely to face major anti-trust challenges in the U.S. (All figures in this section are in U.S. dollars.)

It’s interesting to note that 7-Eleven has been much better at running convenience stores in Japan (where it has a 38% profit margin) versus outside of Japan (where it has a 4% margin). That’s partly due to the fact that locations outside of Japan sell a large amount of low-margin gasoline. Couche-Tard, however, has been able to unlock margins in the 8% range in similar gasoline-dominated locations, indicating substantial room for growth. With 7-Eleven’s overall returns falling far behind its Japanese benchmark index over the last eight years, there is clearly a business case to be made to current shareholders.

The political dimensions to the acquisition are much harder to quantify than the business case. While Japan did change its laws to become more foreign-acquisition-friendly in 2023, it still classifies companies as “core,” “non-core” and “protected,” under the Foreign Exchange and Foreign Trade Act. Logically, it seems that a convenience-store company would fit the textbook definition of “non-core.” However, Seven & i Holdings has asked the government to change the classification of its corporation to “core” or “protected.” That would effectively kill any wholesale acquisition opportunities.

There is also an American legal aspect to the deal. The Federal Trade Commission (FTC) would have to rule on whether ATD’s resulting U.S. market share of 13% would be too dominant. Barry Schwartz, chief investment officer and portfolio manager at Baskin Wealth Management, speculated that the most likely outcome might be a sale of 7-Eleven’s overseas assets to ATD, with the company holding on to its Japan-based assets.

With all the press coverage of the potential 7-Eleven acquisition, it may have slipped under the radar that Couche-Tard completed a $1.6-billion purchase of 270 convenience stores from the Giant Eagle supermarket chain. Couche-Tard CEO Brian Hannasch commented, “The fragmented market in the United States offers significant consolidation opportunities, and the challenging economic landscape is accelerating this trend, creating exciting growth prospects for us. With our strong balance sheet and customary financial discipline, we are optimistic about future deals at the right price and fit.”

Against this background of aggressive acquisition announcements, ATD released its quarterly earnings this week. Earnings per share came in at $0.83 (versus a predicted $0.84) and revenues of $18.28 billion (versus a predicted $17.97 billion). The market appeared to take the news in stride as shares were up 1.32% on Thursday.

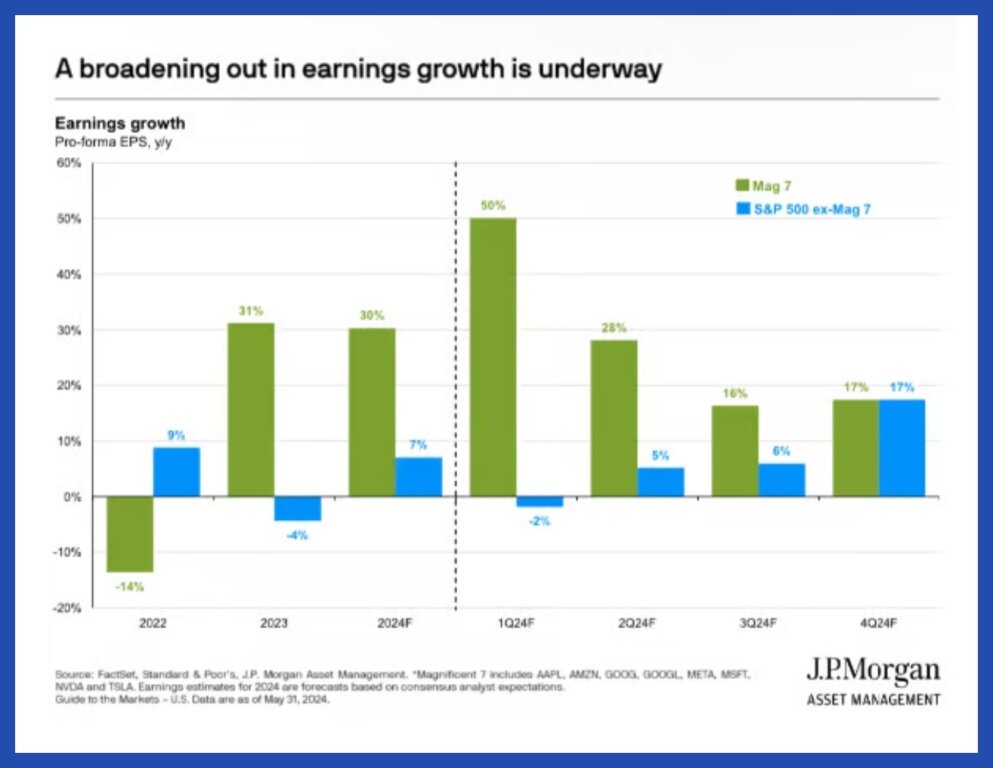

For the last few years, the so-called Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) have absolutely crushed the rest of the world’s stocks. You can see below the strong performance of these stocks over the first half of 2024, as well as over the past few years.

Source: Investopedia.com

But that trend might be changing. Given how strongly these companies performed in the first half of 2024, we might be off on our prediction that the S&P/TSX Composite Index would have higher returns than U.S. tech stocks for the year. That said, if we compare the Roundhill Magnificent Seven ETF (MAGS) and the S&P/TSX Composite Index over the last month, we see very similar returns.

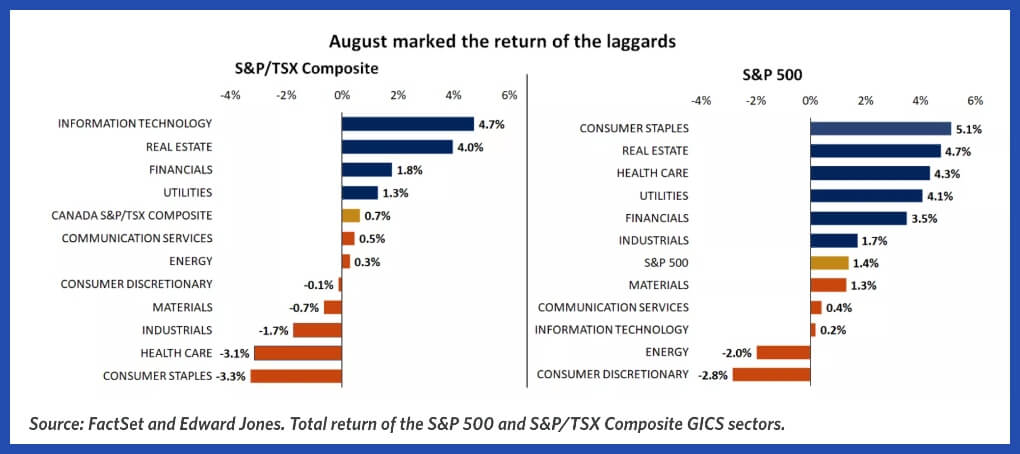

If we look at how those seven stocks performed in August relative to the rest of their S&P 500 cousins, we see that market leadership is broadening out to include other sectors.

Source: EdwardJones.ca

Source: JPMorgan.com

It’s not like the Mag 7 aren’t all great companies (although we have our doubts about Tesla). It’s simply that with overall market enthusiasm growing, and tech valuations getting stretched further and further, outperformance going forward is by no means guaranteed. As interest rates decrease, Canadian investors and U.S. value investors are certainly hoping that money continues to move from high-flying tech stocks to more traditional market leaders.

Notably, with nearly all U.S. earnings reported for the second quarter, about 80% of S&P 500 companies exceeded analyst profit estimates. The earnings for the index grew 11.4%. This earnings performance supports the theory that the current bull market run is at least somewhat supported by companies simply making more money.

Sure, the U.S. might have the market cornered when it comes to trillion-dollar tech companies—but Canada has by far the best-performing dollar store in North America right now: Dollarama Inc. (DOL/TSX).

Figures are in U.S. dollars.

With Dollarama Inc. announcing second-quarter earnings next week, the market appears to be hopeful that outperformance versus its U.S. counterparts will continue. Below are recent figures for Dollar Tree, Dollar General and Dollarama.

Source: Google Finance

Source: Google Finance

Source: Google Finance

So what accounts for this massive discrepancy in outcomes for what appear to be pretty similar retail strategies?

It appears to be some combination of the following:

Dollarama had an excellent first quarter, where it saw same-store sales grow 5.6% year-over-year, and that came on the heels of a 17.1% growth from the first quarter of 2022 to the first quarter of 2023. With many Canadians taking part in a boycott of Loblaw stores, it’s possible that Dollarama is enjoying a bit of a “perfect storm” when it comes to cash-strapped Canadians entering its doors.

It’s notable that Dollarama has decided to pursue a Latin America-based expansion strategy instead of trying to compete in the saturated U.S. market.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email